Pros

No account minimums for self-directed traders

Four distinct platforms included

Lots of different account types

Cons

Potential for high mutual fund transaction fees

No platform has universal access

If you regularly watch TV or consume digital finance media, you’ve probably seen a commercial for TD Ameritrade. An early entrant to the online brokerage space — one backed by the heft of a major North American financial services company — TD Ameritrade has the time and cash to make sure everyone knows its name.

But don’t move your money to a new brokerage just because it happens to be a household name. Does TD Ameritrade bring the goods to back up its relentless air campaign?

The short answer is yes. TD Ameritrade is suitable for a wide range of investors and traders, from relatively inexperienced DIYers to sophisticated day traders to high-asset managed investment clients. That’s thanks to an unusually broad array of account options, trading platforms, and self-directed and managed investment products.

This low-cost online broker should absolutely be in the mix for anyone seeking a better way to trade stocks, exchange-traded funds (ETFs), fixed-income instruments, and alternative assets.

Just be aware that product lineup and availability, including core mobile and desktop platforms, may be impacted by TD Ameritrade’s pending merger with Charles Schwab.

TD Ameritrade Account Types

TD Ameritrade has several distinct account types:

- Standard self-directed taxable brokerage account

- Traditional IRA

- Roth IRA

- Rollover IRA

- 529 plans

- Coverdell education savings account

- UTMA and UGMA accounts (for tax-advantaged gifting to minors)

- Specialty accounts, including individual trusts, business accounts, and pension accounts

- Managed portfolios (for hands-off investors)

Review IRS guidance and speak with your tax professional for situation-specific information about tax-advantaged account benefits and limitations before opening an account.

TD Ameritrade Platform Options

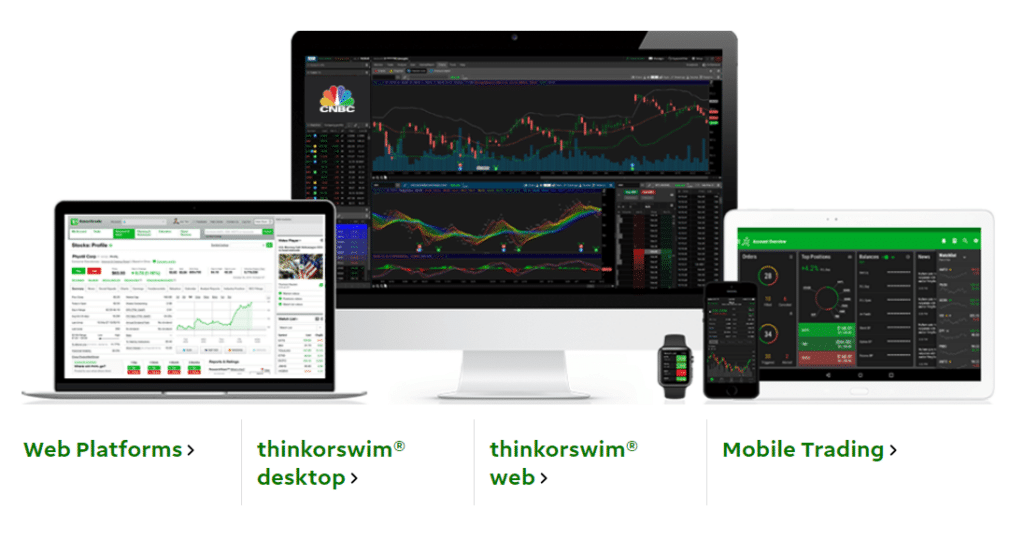

All TD Ameritrade account holders have access to four distinct platforms that carry no platform charges or hidden fees (although the two iOS and Android-compatible mobile trading platforms have many features in common):

Web Platform

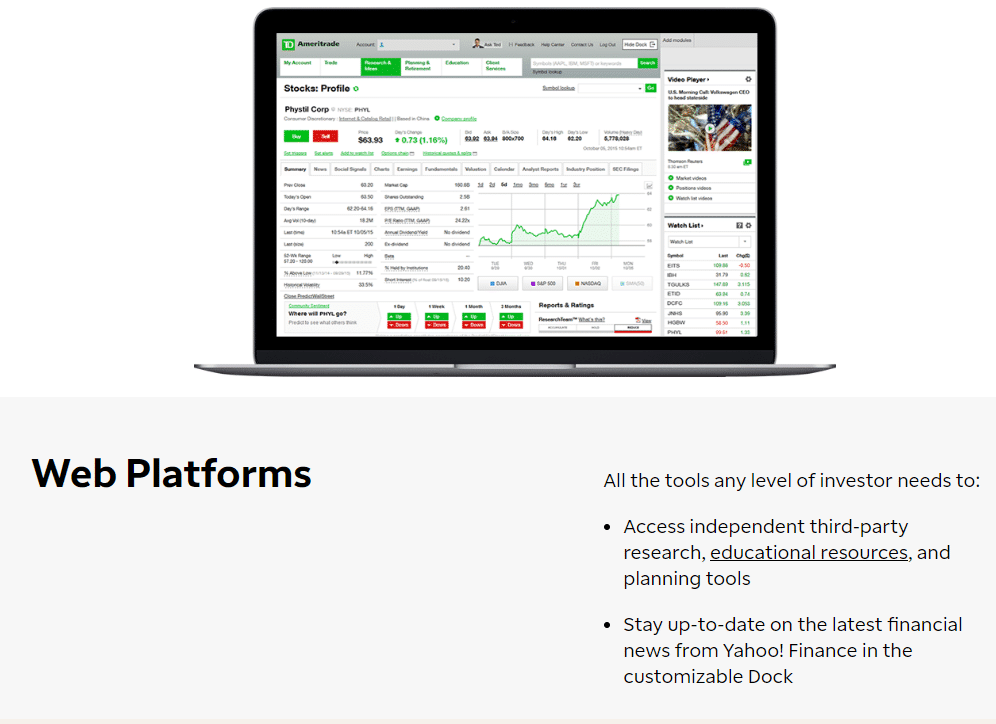

TD Ameritrade’s desktop trading platform features stock screeners, event calendars, watchlists, and tax reporting, giving it a familiar feel to anyone who’s traded through a discount online brokerage before. But it does have some TD-exclusive curveballs, including SnapTicket, a sort of portable stock listing that displays details of individual equities at a glance, and a social signals tool that measures real-time changes in stock-specific social sentiment through a Twitter API.

The Web platform is most appropriate for occasional DIYers (folks who rarely make more than a few trades per week).

thinkorswim

TD built the thinkorswim platform for sophisticated, high-frequency traders who need powerful analytics and charting capabilities. Unlike the web platform, thinkorswim is best for active traders, day traders, and devoted hobbyists with the means and inclination to spend much of the workday in front of a trading terminal. TD Ameritrade has a helpful primer on Thinkorswim if you want to know more.

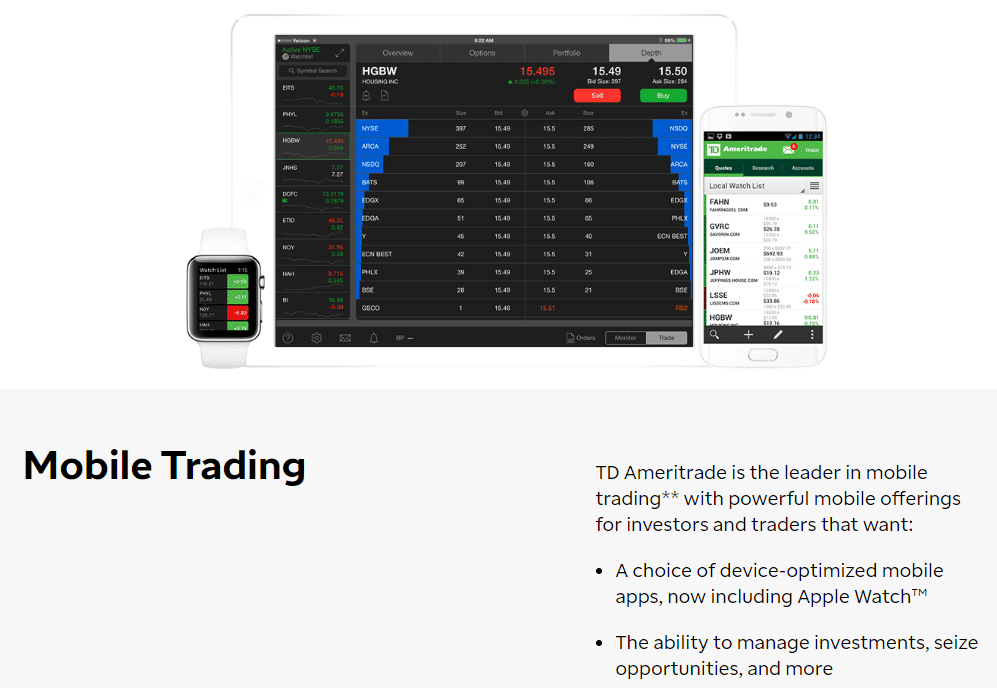

TD Ameritrade Mobile (Mobile App)

TD Ameritrade’s basic mobile trading platform is a stripped-down version of the Web platform. Available on Apple and Android devices, it has everything you need to make uncomplicated trades on the go.

thinkorswim Mobile

The thinkorswim Mobile app replaces TD Ameritrade Mobile Trader, which was an intermediate step between the basic mobile platform and the thinkorswim desktop app. Now, TD Ameritrade offers the full power of thinkorswim in mobile form for experienced traders on the go.

Self-Directed Investment Products & Trading Commissions at TD Ameritrade

TD Ameritrade’s self-directed portfolios feature a broad swathe of available investment products.

Stocks and ETFs

TD Ameritrade facilitates commission-free trading in exchange-traded and over-the-counter stocks in the U.S. and select foreign markets. Its commission-free ETF database includes hundreds of index, sector, and objective-driven securities.

Mutual Funds

TD Ameritrade offers access to hundreds of load, no-load, and no-transaction-fee mutual funds. There’s a nice variety of no-transaction-fee funds here, but commissions for no-load funds are very high: about $50 per trade. As is the case with all mutual fund trades, orders don’t go through until the close of business on the day you place them (if you place them during regular trading hours). So, mutual funds aren’t appropriate for traders looking to time short-term market moves.

Fixed Income Securities

TD Ameritrade’s fixed-income offerings include government bonds, corporate bonds, and annuities. Pricing varies by several factors, including product and transaction size. Note that government-issued bonds may have tax advantages, even when added to taxable portfolios.

Futures

TD Ameritrade offers competitively priced futures trades in about 70 instruments, including relatively liquid index futures. Expect to pay $2.25 per trade, although that may not encompass the final cost of each transaction and doesn’t account for margin requirements, which you must satisfy before making your first futures trade.

Forex

TD Ameritrade facilitates trading in about 20 global currencies and several times that number of pairs. Its database includes less common forex opportunities, like the South African rand, Thai baht, and Czech koruna. Forex trading costs vary by several factors, including currency, transaction volume, and exchange rate.

Cryptocurrency

While TD Ameritrade doesn’t offer direct cryptocurrency trading, it does offer three different ways to gain exposure to crypto:

- Over-the-counter cryptocurrency trusts, which are similar to closed-end funds with high volatility, limited liquidity, high fees, and risk of loss of principal

- Crypto mutual funds and ETFs

- Bitcoin futures through the Chicago Mercantile Exchange (CME)

These crypto trading options may require approval by TD Ameritrade.

TD Ameritrade Managed Portfolios

For passive investors who prefer not to keep close watch over their portfolios, TD Ameritrade has two managed portfolio options, each with its own minimum deposit requirements and fee schedule:

Selective Portfolios

Featuring a wide range of ETFs and mutual funds, Selective Portfolios require at least $25,000 in investable assets and carry variable management fees that depend on the composition, complexity, size, and goals of each investor’s portfolio.

Selective Portfolios is best thought of as a high-end robo-advisor with human support to back it up.

Personalized Portfolios

This gold-plated tier includes wholly customized portfolios with access to a dedicated financial consultant and a separate portfolio management professional charged with closely managing portfolio balance and performance.

TD Ameritrade’s portfolio managers work closely with advisors from Morningstar Investment Management, a top-rated financial services provider.

Personalized Portfolios’ reporting features are far more advanced than the other two tiers’, with custom goal-tracking and account snapshots across TD and non-TD accounts.

The minimum investment is $250,000 aggregated across all active TD Ameritrade investment accounts. Management fees vary by portfolio composition, complexity, goals, and size.

Additional Features of TD Ameritrade

TD Ameritrade has some additional features worth noting. Together, they add tremendous value to the platform.

Margin Trading

TD Ameritrade’s margin trading vertical appeals to speculative traders with the confidence and knowledge to employ sophisticated trading strategies that could magnify their gains — or losses.

Margin traders use funds borrowed against the value of their portfolios to purchase additional equities, increasing their upside when values subsequently increase and downside when values subsequently decrease.

To open a margin account, simply select the “active trading” option and deposit the $2,000 minimum investment. You must keep at least 30% of your portfolio in equities at all times to offset potential losses of borrowed funds.

It’s important for first-timers to understand that margin trading is appropriate only for sophisticated investors. More so than cash trading, where portfolio losses are limited to the cumulative cost basis of its equity holdings, margin trading carries a significant risk of financial loss.

Education and Research Resources

TD Ameritrade has more investor education resources than your typical discount brokerage. Some highlights from its education vertical include:

- Immersive trading courses led by actual investing experts

- Instructional videos, articles, and tutorials

- Access to dozens of investing publications (some of which may charge subscription fees for premium content)

- “Talking Green” podcast, a TD-sponsored investing show that regularly produces new episodes

- TD Ameritrade Network, best described as a subdued, lower-budget version of Bloomberg TV

- Goal-specific education modules, such as investing for retirement or college education

TD Ameritrade also has some useful market research tools, including:

- Market Edge, a compilation of top-shelf market research from third-party sources

- Social sentiment insights pulled from Twitter — a nontraditional, inexact, forward-looking read on how regular consumers and investors feel about equities in the news

- Premier List, an exclusive list of top recommended buys hand-curated by experts from Morningstar

- Market Java, a morning newsletter featuring overnight breaking news and data from overseas markets

Physical Branch Network

TD Ameritrade has physical branches in most states, per their current branch list. All account holders are entitled to free investment consultations with branch-based staff, not just managed portfolio clients.

Bear in mind that these meetings are golden opportunities for TD Ameritrade to sell customers on more profitable services, such as managed portfolios.

If you’re a committed DIYer, you’ll probably never need to set foot in a TD Ameritrade branch unless you have an unusual account type that requires in-person funding or paperwork processing.

Advantages of TD Ameritrade

TD Ameritrade’s top advantages include no account minimums for self-directed investors, multiple trading platforms, powerful trading tools for serious investors, a vast array of investing options and account types, excellent customer service, and top-flight research tools.

- No Account Minimums for Self-Directed Investors. TD Ameritrade doesn’t require self-directed investors to make minimum investments as a condition of account opening. That’s good news for newer, lower-asset investors looking to get their feet in the door.

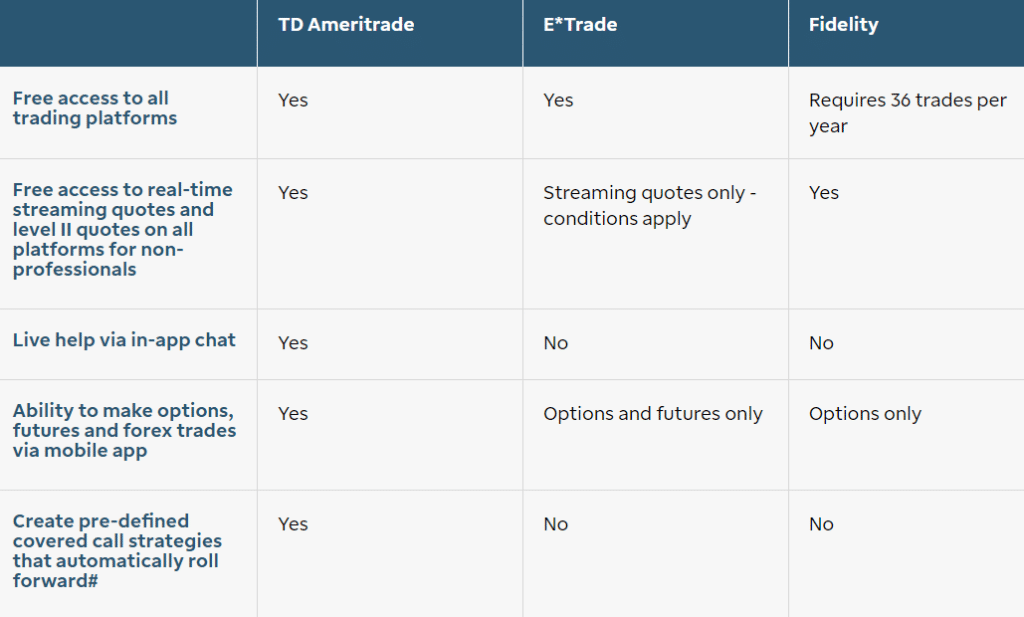

- Access to Four Distinct Trading Platforms at No Additional Cost. All TD Ameritrade account holders have access to four distinct trading platforms with no platform fees. You only pay when you place certain kinds of trades, such as futures and forex.

- Access to thinkorswim for Sophisticated Traders. The thinkorswim platform is a powerful tool appropriate for sophisticated, high-frequency traders. That’s an appealing prospect for confident traders who nevertheless seek the peace of mind that comes with full-service brokerage investing.

- Vast Array of Investing Choices. TD Ameritrade account holders have access to a wide range of investment products, from blue chip stocks and investment-grade bonds to forex. If it trades on an exchange, you can probably find it here.

- Lots of Account Types. TD Ameritrade also has a slew of different account types, including less common or specialized products such as pensions and trusts. That’s a significant advantage over some competing discount brokerages, which stick to more common account types like taxable brokerage accounts, traditional IRAs, and Roth IRAs.

- 24/5 Trading. TD Ameritrade offers 24/5 extended-hours trading in about two dozen ETFs selected to provide access to a broad range of market sectors. You can trade these securities in real time from 8pm Eastern on Sunday until 8pm Eastern on Friday.

- 24/7 Customer Service. TD Ameritrade makes human agents available around the clock to assist with technical issues and basic questions about trading and investing. Licensed advisors are available during extended business hours.

- Access to Top-Flight Research Tools. TD Ameritrade puts a wealth of research tools at account holders’ fingertips, all at no extra charge. The Market Edge package is particularly useful for traders and investors eager to dive behind the headlines without wading through complex book-length research reports or paying a premium for subscriptions to third-party research services.

- Dozens of Physical Branches. TD Ameritrade has a pretty dense physical branch network spanning the entire United States (including one branch each in Alaska and Hawaii). If you live in or near a major city, there’s a good chance you’re within driving distance of at least one TD Ameritrade branch — a perk if you value face-to-face interaction with financial professionals.

Disadvantages of TD Ameritrade

TD Ameritrade’s disadvantages include high minimums and vague fees for managed portfolios, high mutual fund transaction fees, and no universal product access on a single platform.

- High Mutual Fund Transaction Fees. TD Ameritrade charges a lot for no-load mutual fund trades not included in its no-transaction-fee bundle. If you intend to build a self-directed portfolio with a high proportion of mutual funds, look for another trading partner.

- No Single Platform Offers Universal Investment Product Access. None of the four TD Ameritrade trading platforms include access to every investment product in the brokerage’s network. The thinkorswim Mobile app comes close, but it’s still not universal. If you plan to take advantage of everything TD Ameritrade has to offer, you must use at least two trading platforms.

Final Word

TD Ameritrade is a full-service brokerage that’s almost all things to all investors. Although it has multiple ideal users, it really shines on the DIY side, with a ton of easy-to-use trading tools and educational resources for self-directed investors committed to honing their craft.

The managed side is excellent too, but you must bring at least $250,000 to the table to enjoy the sort of bespoke, white-glove relationship many expect from investment management.

Still, the takeaway is clear: TD Ameritrade is an above-replacement brokerage that deserves close consideration from virtually anyone in the market for a new place to trade and invest.

Pros

No account minimums for self-directed traders

Four distinct platforms included

Lots of different account types

Cons

Potential for high mutual fund transaction fees

No platform has universal access