Pros

Account opening bonus opportunity

Easy to avoid the monthly maintenance fee

Simple mobile check deposit

Cons

Strict cash deposit limits

High excess transaction fees

Smallish ATM network

Chase Business CheckingSM is part of the Chase for Business vertical, which includes a host of small business credit cards (including the excellent Chase Ink Business Preferred® Credit Card) and business savings accounts.

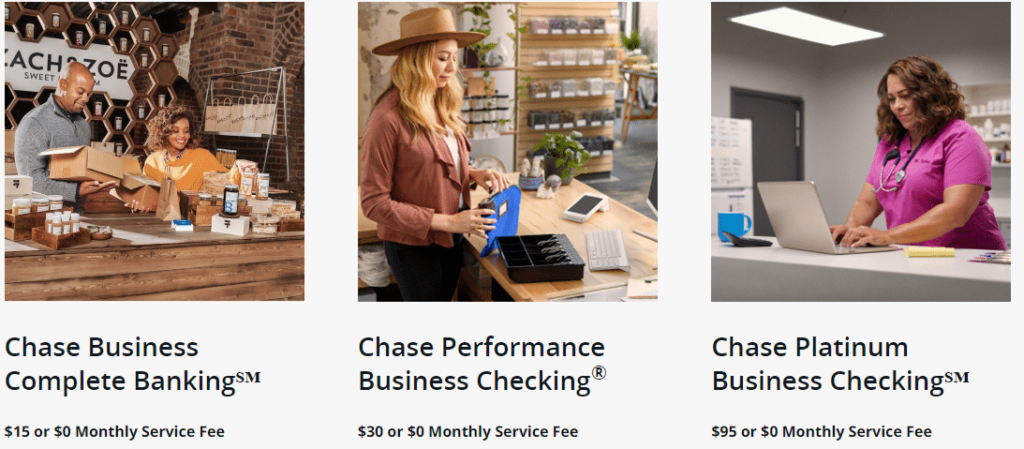

Chase has three main business checking accounts: Chase Business Complete Checking®, Chase Performance Business Checking®, and Chase Platinum Business CheckingSM. All three can help reduce common business expenses and facilitate business funding initiatives for nascent startups and mature enterprises alike.

Here’s what you need to know about Chase’s three main business checking accounts.

Key Features for Each Chase Business Checking Account

Here’s what you need to know about each Chase Business Checking account.

Chase Business Complete Checking®

This is Chase’s “entry level” business checking account – though it’s far from basic. Here’s what you need to know about it.

- Account Opening Bonus: Open a new Chase Business Complete Checking account online or in person and complete qualifying activities to earn up to a $400 bonus. This offer is valid though April 18, 2024.

- Minimum Opening Deposit: There’s no minimum deposit required to open this account.

- Monthly Maintenance Fee: $15, but can be waived in multiple ways, including maintaining a required minimum balance or completing qualifying transactions on your Chase Ink Business credit card.

- Transaction Limits: Enjoy unlimited electronic deposits, ACH, and mobile check deposits via Chase QuickDeposit.

- Cash Deposit Limits: See terms for information about cash deposit limits.

Chase Performance Business Checking®

This is Chase’s mid-level business checking account. It’s ideal for established midsize businesses with straightforward cash management needs.

- Minimum Opening Deposit: The minimum opening deposit is $25.

- Monthly Maintenance Fee: $30, waived when you maintain qualifying business account deposits (across all linked business accounts) of $35,000 or more.

- Transaction Limits: Up to 250 free transactions per month and unlimited deposits, including incoming wires. The transaction limit excludes outgoing wire transfers, but the account does include two outgoing wires at no charge. Above the limit, the transaction fee is $0.40.

- Cash Deposit Limits: Up to $20,000 in fee-free cash deposits per month.

Chase Platinum Business CheckingSM

This is Chase’s top-tier business checking account. It’s designed for larger businesses that need to handle lots of transactions.

- Minimum Opening Deposit: The minimum opening deposit is $25.

- Monthly Maintenance Fee: $95, waived when you maintain qualifying business account deposits (across all linked business accounts) of $100,000 or more.

- Transaction Limits: Up to 500 free transactions per month and unlimited deposits, including incoming wires. Up to four outgoing wires are included at no charge, with standard wire transfer fees applying above that limit. The post-limit transaction fee is $0.40.

- Cash Deposit Limits: Up to $25,000 in fee-free cash deposits per month.

This isn’t a full accounting of all the fees and limitations that you could encounter as a Chase Business Checking customer. For a complete guide to each account, call Chase’s business banking helpline at or check in with a business banker at one of the company’s many U.S. branches.

Key Features for All Chase Business Checking Accounts

All of Chase’s business bank accounts have some useful features for account holders.

Online Banking With Bill Pay

Chase’s online banking suite includes:

- Online Bill Pay: Fee-free bill payments (subject to transaction limits) to vendors, contractors, and others.

- Account Activity Sync: Easily download account activity to QuickBooks and other accounting platforms for easy offline and on-the-go access.

- Account Alerts: Text, push, and email alerts for important account events, such as incoming deposits, low balances, and more.

- Mobile Banking: Chase’s mobile banking app offers full functionality on iOS and Android devices.

- Paperless Statements: All Chase business checking customers are eligible for paperless statements, which may reduce monthly maintenance fees.

Complimentary ATM Access and Debit Cards

All Chase business checking account holders enjoy complimentary business debit cards and fee-free access to more than 15,000 Chase ATMs around the United States. Chase also has more than 4,700 physical bank branches in the U.S., though they’re not evenly distributed across the country.

Chase QuickDepositSM

Chase QuickDeposit is a user-friendly mobile check deposit tool that’s free for low-volume users. To deposit a check at no charge, simply follow the prompts in the mobile check deposit app.

If your business processes a lot of paper checks, you’ll want a physical check scanner. A single-feed check scanner is free to purchase, but requires a $25 monthly fee on a two-year contract. A multi-feed check scanner, which is ideal for high-volume deposits, requires a $50 monthly fee on a two-year contract and no upfront charge.

Chase Payment Solutions (Formerly Chase Merchant Services)

Chase’s Chase Payment Solutions umbrella includes a slew of services and solutions for merchants that need to accept payments in-person, online, and over the phone.

For in-person transactions, merchants can choose from several different POS configurations for terminal, pay-at-the-table, and mobile sales. For remote transactions, Chase offers virtual terminal and e-commerce portal solutions. These solutions may carry equipment and maintenance fees, and may require longer-term contracts, so talk to your Chase banker for more information.

Chase Business Banking Services

In addition to the services and solutions outlined above, Chase offers lockbox, cash (Branch Deposit Express), and cash vault services for larger businesses that need to rapidly and accurately process lots of transactions. These services may carry additional fees and limitations; talk to your banker for more details.

Advantages of Chase Business Checking

These are the top advantages of Chase’s business checking suite. Key benefits include mobile check deposit, convenient monthly fee waivers, and access to thousands of Chase branches.

- Relatively Easy to Avoid Monthly Maintenance Fees in Chase Business Complete Checking. There are multiple ways to avoid the $15 monthly maintenance fee in your Chase Business Complete Checking account, including maintaining a required minimum balance or completing qualifying Chase Ink Business Credit Card transactions.

- User-Friendly Mobile Check Deposit. Chase’s user-friendly QuickDeposit tool is a boon for business owners who don’t work within easy reach of a physical Chase branch or ATM – and those who simply can’t find the time to visit the bank themselves. If you’re a landlord who needs to cash security deposit checks on the go, for instance, this is a lifesaver. The mobile check scanning app is free to use; for higher deposit volumes, you’ll want a check scanner, which requires a contract and $25 to $50 monthly fee.

- Free Access to More Than 4,700 Branches. Chase has more than 4,700 physical branches around the United States. That’s a big advantage over mostly or solely online banks like Capital One (which has just a few physical branches) and Ally Bank (which has no physical branches). Even with Chase’s comprehensive, user-friendly online tools, it’s always nice to be able to talk to a banker in person.

Disadvantages of Chase Business Checking

Chase Business Checking does have some drawbacks, including strict cash deposit limits, a relatively small ATM network, and no interest on deposits.

- Relatively Strict Cash Deposit Limits. No matter which Chase Business Checking account you select, you can’t deposit more than $25,000 cash per month. This is a problem for cash-heavy businesses, such as restaurants and retailers.

- Excess Transactions Incur a $0.40 Fee. If your business conducts lots of small-dollar transactions (or lots of transactions in general), Chase Business Checking might not be for you. Depending on your account level, as few as 101 transactions per month can trigger the $0.40-per-transaction fee. Some competing accounts, including Capital One Spark Business Checking, have no transaction limits and no fees for excess transactions.

- Smallish ATM Network. Chase has just 15,000 fee-free ATMs in the U.S. This is far fewer than Capital One, whose Spark Business Checking account comes with access to nearly 40,000 fee-free ATMs.

- No Interest on Deposits. These accounts don’t pay interest on deposits. While business checking accounts generally aren’t as generous as business savings accounts in the interest department, some major banks do at least pay token interest on deposits. For instance, Wells Fargo’s top-tier business account is interest-bearing.

How Chase Business Checking Stacks Up

Chase Business Checking competes against a number of other big banks’ business banking solutions. One of its top competitors is Huntington Bank. The two institutions’ business banking offerings share a surprising amount in common — here’s how they stack up.

| Chase Business Checking | Huntington Bank Business | |

| Monthly Fees | Ranging from $15 to $95 | Ranging from $0 to $0 |

| Monthly Fee Waivers? | Yes | Yes |

| Account Opening Bonus | Up to $400 | Up to $750 |

| Unlimited Transactions? | No | Yes, on certain accounts |

Final Word

Chase Business Checking is one of the most recognizable business checking solutions out there, but it’s probably not the only financial solutions your company needs.

That’s fine by Chase. As one of the biggest banks in the United States, Chase has a nice lineup of business savings solutions, including traditional savings accounts and CDs, so you’ll want to look into those if you’re not impressed by Chase Business Checking’s lack of interest-bearing options. It also has multiple credit card options for businesses and consumers alike, including some of the top travel rewards credit cards and cash back credit cards on the market.

And, of course, your Chase banker is always happy to discuss borrowing options with you. In other words: No matter what your growing business needs, Chase can probably help.

Just be sure to compare their offerings to the competition. No one is perfect, after all, and it’s never been easier to learn what else is out there.

Pros

Account opening bonus opportunity

Easy to avoid the monthly maintenance fee

Simple mobile check deposit

Cons

Strict cash deposit limits

High excess transaction fees

Smallish ATM network