At a Glance

- A credit freeze prevents scammers from opening a new credit line in your name.

- Freezing your credit is free.

- A credit freeze lasts until you lift it.

- Credit freezes don’t totally prevent fraud. Scammers can still access and use any of your existing accounts.

There are plenty of ways bad guys can get ahold of your personal information. From data breaches to credit card scams, it’s all too easy for a criminal to wreck your finances before you know what’s happened.

One way to protect yourself is to place a freeze on your credit. It’s relatively simple to do, but it doesn’t shield you from all forms of fraud. Knowing what a credit freeze does — and doesn’t do — will help you keep your info as safe as possible.

What Is a Credit Freeze & How Does It Work?

A credit freeze, also known as a security freeze, is a way to prevent scammers from opening a new credit line in your name.

When you apply for a new line of credit, such as a credit card or a loan, the lender checks your credit report to see if you’re a responsible borrower. A credit freeze locks your credit file, preventing anyone besides you from accessing it.

You can still get a copy of your credit report, but you can’t apply for a new line of credit until you unfreeze your file. No one else can access your report while your credit is frozen. You can still use your existing credit accounts.

Freezing your credit is free with all three credit reporting bureaus, and a freeze lasts until you lift it.

Why You Might Want to Freeze Your Credit

The main reason to freeze your credit is to prevent fraud. If you’ve lost your card, suspect your identity has been stolen, or your bank has experienced a data breach, a credit freeze can stop further damage by preventing scammers from opening a new credit account in your name. You can also freeze your credit proactively to avoid future fraud.

You can also use a credit freeze to make it harder for you to apply for new credit. If you’re struggling with mounting debt and worried you’ll be tempted to take on more, a credit freeze adds a layer of hassle that might be enough to make you think twice.

Pros & Cons of Freezing Your Credit

There’s no real harm in freezing your credit. It’s a quick and relatively easy way to protect your finances from thieves and scammers. However, it’s not foolproof, so it’s important to know its limitations.

Pros

A credit freeze offers the following benefits:

- It Protects Against Some Fraud. No one can take out a new line of credit in your name when your credit is frozen.

- It’s Free. It costs nothing to freeze your credit with all three credit bureaus.

- You Can Unfreeze Your Credit As Needed. If you want to apply for new credit, you can contact the bureaus to lift the freeze. You can re-freeze your credit after that.

Cons

That said, there are drawbacks to freezing your credit:

- It Takes a Few Steps. You must contact all three credit reporting bureaus to freeze your credit. There’s no one-stop way to do it.

- It Makes Applying for New Credit a Hassle. You must contact each bureau to unfreeze your file if you want to apply for new credit. The credit bureaus are required to lift a freeze within the hour if you request it by phone or online, but they have three business days if you submit the request by mail.

- It Can Provide a False Sense of Security. A credit freeze prevents anyone from opening a new credit account in your name. However, thieves can still access and use any of your existing accounts. Don’t rely on a freeze alone to keep you safe.

How to Freeze Your Credit

Freezing your credit is a straightforward process. You’ll need to contact each of the three credit reporting bureaus to request a freeze. Here’s how:

| Credit Bureau | Contact Information |

| Equifax | Call 800-685-1111 or visit https://www.equifax.com/personal/credit-report-services/ |

| Experian | Call 888-397-3742 or visit https://www.experian.com/freeze/center.html |

| TransUnion | Call 888-909-8872 or visit https://www.transunion.com/credit-freeze |

Should you want to apply for new credit, you can contact the bureaus to request they lift the freeze temporarily.

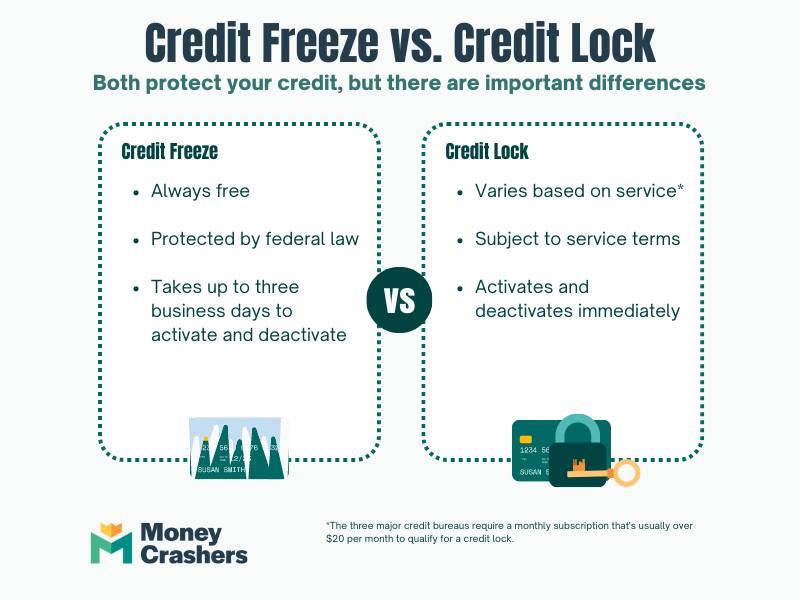

Credit Freeze vs. Credit Lock

A credit lock works the same as a credit freeze. It’s a service provided by all three credit unions, sometimes for free and sometimes for a fee. As with a freeze, it prevents anyone from getting new credit in your name.

A lock is easier to lift than a freeze. You can often unlock your credit instantaneously with a quick click on the bureau’s app. To unfreeze your credit, you must contact the bureau, and there may be a waiting period before the lift goes into effect.

However, a credit freeze offers more protection. Freezes are subject to federal law, whereas each bureau sets its own credit lock terms. As a rule, you’re better off dealing with the minor hassles of a credit freeze to get the added protection.

Credit Freeze FAQs

A credit freeze isn’t complicated, but there are some commonly asked questions about the process.

How Long Does a Credit Freeze Last?

A credit freeze lasts until you contact the credit reporting bureaus to remove it.

How Much Does a Credit Freeze Cost?

It’s free to freeze your credit with all three bureaus.

Does a Credit Freeze Impact Your Credit Score?

A credit freeze does not affect your credit score. However, it might protect it from damage caused by identity theft.

Does a Credit Freeze Prevent All Credit Checks?

A credit freeze should not affect your ability to get a job, rent a property, or apply for insurance. It only affects your ability (or a stranger’s ability) to open new credit in your name.

Can I Freeze My Child’s Credit?

If you have a child under 16, you can freeze their credit. Download a request form from Equifax and Experian and follow TransUnion’s instructions to create a written request. Send in the request and any required documentation showing you have the authority to act on your child’s behalf.

What’s the Difference Between Freezing Your Credit & Freezing a Credit Card?

Freezing an individual credit card prevents any additional purchases using that card. It’s helpful if your card has been lost or stolen or if you want to stop yourself from accumulating any extra debt on the card. You must still make monthly payments on the account, and interest continues to accrue on the balance.

Final Word

A credit freeze is one way to protect your finances from fraud. But it doesn’t do everything. Thieves can still access your existing credit when your file is frozen, so you must take other steps to protect your information.

Use strong passwords, install antivirus software, and regularly check your credit report and account statements. If you spot suspicious activity, report it immediately. As the saying goes, an ounce of prevention is worth a pound of cure.