Upstart Personal Loans

Upstart Pros

- Inclusive underwriting process

- Rapid funding

- Potential for high borrowing limits

- No prepayment penalties

Upstart Cons

- Potential for high origination fees

- Only one core credit product

- Only two term options

Looking for an unsecured personal loan? Have decent credit or better? Not sure you want to deal with the red tape you’re apt to encounter at a traditional bank? If so, you might be in the market for an unsecured personal loan from Upstart, an online-only personal loan broker based in the San Francisco area.

Upstart issues fixed-rate personal loans to U.S.-based borrowers who meet its credit, income, and employment criteria. Well-qualified borrowers snag rates as low as 7.35% APR, subject to change with prevailing interest rates, and loan principals as high as $50,000. Upstart partners with third-party bank lenders to initiate loans funded by individual or institutional investors.

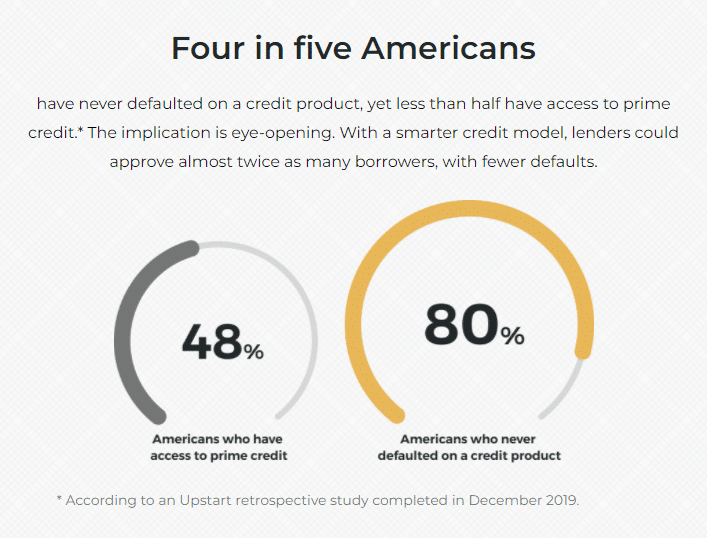

Unlike some competitors, Upstart casts a wide underwriting net, evaluating applicants’ educational attainment, area of study, and employment history in addition to more typical factors like credit score and credit history. If you’ve had trouble qualifying for personal loans at other online-only lenders, it’s worth your while to give Upstart a shot.

Let’s take a closer look at Upstart’s loans, lending process, benefits, drawbacks, and overall suitability.

Getting a Loan With Upstart

Upstart’s core product is an unsecured personal loan. Here’s what you need to know about it.

Upstart’s Loans: Characteristics and Restrictions

Upstart issues unsecured loans with principals ranging from $1,000 to $50,000. In some jurisdictions, the minimum loan amount may be higher; for instance, it’s $6,000 in Ohio and $7,000 in Massachusetts. The maximum loan amount depends on your borrower profile, which includes credit factors such as credit score and history, and noncredit factors such as employment history and income. As with all Upstart loan features, it’s subject to change in accordance with company policy.

Upstart’s loan terms are 36 months (3 years) or 60 months (5 years). Origination fees range from 0% to 8% of the loan principal, depending on your borrower profile and loan term. Your origination fee, if any, is deducted from your loan principal at funding. Loan rates are fixed for the life of the loan and currently range from 3.22% to 35.99% APR. However, the lowest rates (sub-7%) are reserved for loans secured by personal property, such as an auto title.

If you choose to make additional principal payments or pay off your loan in full ahead of schedule, Upstart does not charge a prepayment penalty. Other than the origination fee, the only common fees associated with Upstart loans are a late payment fee, which is the greater of $15 or 5% of the monthly past-due amount, charged on payments made more than 10 days past the monthly due date, and a $15 failed payment fee.

Upstart’s loans can be used for:

- Refinancing existing student loans

- Debt consolidation

- Paying off credit card debt

- Funding education expenses, including tuition

- Funding major projects, such as home improvements or additions

- Paying recurring or one-off bills, such as medical or car repair bills

- Covering tax expenses (an alternative to paying taxes with a credit card)

- Financing a major one-off purchase, such as a new car

- Financing discretionary expenses, such as an international vacation or wedding

- Starting or expanding a business

Upstart’s loans aren’t suitable for everything. If you’re unsure whether you can use an Upstart loan for a particular purpose, discuss it with a loan specialist.

Checking Your Loan Rate

The first step in Upstart’s loan application process is a quick rate check. Choose your loan purpose from the drop-down menu on Upstart’s home page, then click “Check Your Rate.” On the next page, you’ll need to provide a fair bit of detail about your identity, employment, and finances, including:

- Desired loan amount

- Name and address

- Date of birth

- Phone number, email, and unique account password

- Annual income from all sources you wish to share

- Income type (such as salary or hourly wage)

- Employment history (employer, start date)

- Educational attainment (highest degree)

- Educational record (name of institution, field of study, graduation date)

- Cumulative checking, savings, and investment account balances

- New loans initiated during the preceding three months, if any

- Desired payment method (such as automatic debit or mailed check)

Checking your rate does not impact your credit score. If you wish to proceed with your application, though, you’ll need to consent to a hard credit pull that will temporarily decrease your credit score.

Evaluating and Accepting a Loan Offer

Once you submit your information, Upstart checks your credit score, then issues an application decision. If you qualify to proceed with the application process, you’ll see at least one loan option offering a particular rate, term, and origination fee. Rates on 60-month loans tend to be lower than rates on 36-month loans.

If you wish to proceed, you’ll need to provide your Social Security number and verify any bank accounts you want Upstart to consider during the underwriting process. After applying, you may be required to provide additional documentation, such as pay stubs or tax documents, so it’s best to keep a close watch on your email and phone until your application is formally approved or denied.

Upstart sets itself apart with a proprietary underwriting process that takes into account a variety of noncredit factors, including your employment history, professional marketability — as measured by your field of study — and educational attainment.

Upstart doesn’t provide detailed information about its underwriting criteria, but it’s entirely possible that its bias toward highly educated borrowers allows it to consider applications from prospective borrowers whose credit scores or employment profiles would otherwise disqualify them. I’m just one data point, but I find it noteworthy that Upstart didn’t bat an eye — and, indeed, conditionally approved my application — when I listed my income type as “self-employed” and used the vague category of “media” to describe my job duties. For many lenders, that’s not enough.

Funding Your Loan

Upstart prides itself on rapid funding. If you accept your loan terms before 5pm Eastern time on a business day and Upstart encounters no hitches during the verification process, you’ll receive your funds the next business day. If you accept after 5pm, you’ll receive your funds two business days later. Funds are deposited into the bank account of your choosing, minus the agreed-upon origination fee.

Repaying Your Loan

Beginning the month after your loan is funded, you’ll need to make regular repayments at the agreed-upon fixed payment amount by the monthly due date. Repayments include principal and interest calculated on the loan’s total principal. Repayment options include manual electronic payments, automatic electronic payments (auto-debits), and mailed checks. Payments are considered late after 10 days past due. There’s no penalty for accelerating your repayments or paying off your balance in full before your loan reaches term.

If you need to get in touch with the Upstart team, you can call the toll-free customer support hotline at 855-438-8778 from 6am to 5pm Pacific time (9am to 8pm Eastern time), seven days a week. After regular business hours, email support@upstart.com.

Advantages of Getting a Loan From Upstart

- Innovative, Inclusive Underwriting Process. Upstart’s underwriting process is more inclusive and innovative than the typical personal lender’s, P2P or not. In addition to common factors such as credit history and credit score, Upstart’s proprietary underwriting engine takes into account employment history, educational attainment, and even the borrower’s area of study — which, for better or worse, can significantly impact lifetime earning potential. In other words, Upstart is not a one-size-fits-all lender, and that’s great news for borrowers who don’t fit the traditional mold.

- Rapid Funding. The vast majority of Upstart loans are funded within a single business day. If rapid funding is important to you — and it may well be, if you’re using your loan proceeds for time-sensitive purposes such as debt consolidation — Upstart should be high on your list. Some competing lenders take up to a week to fund the typical loan.

- No Prepayment Penalties. You can pay off your Upstart loan at any time without incurring any financial penalty. This lets you eliminate a recurring monthly expense, budget permitting, without paying extra.

- Borrow Up to $50,000. Well-qualified Upstart applicants can borrow up to $50,000 in a single loan. Some competing lenders’ loans top out at $25,000 or $30,000. If you’re looking to consolidate debts or fund major purchases approaching $50,000, Upstart’s high borrowing cap could be a difference-maker. Just remember that you’re not automatically entitled to a $50,000 loan from Upstart, and your borrower profile may well cap your borrowing capacity below that threshold.

- Some Borrowers Pay Trivial Origination Fees. Upstart has a wide origination fee range. On the bright side, well-qualified borrowers may qualify for sub-1% origination fees, if they’re charged origination fees at all.

- Wide Range of Acceptable Loan Uses. By the standards of the online personal lending category, Upstart’s loans are appropriate for a wider-than-usual range of uses. Notably, Upstart loans can be used to fund tuition and other education expenses. Many competitors specifically exclude this application.

Disadvantages of Getting a Loan From Upstart

- Potential for High Origination Fees. The flip side of Upstart’s wide origination fee range is the potential for extremely high origination fees — up to 8% of the loan principal in the worst case. Upstart determines origination rates on a case-by-case basis and doesn’t reveal precisely how they’re calculated, but applicants with less-than-stellar credit or otherwise weak borrower profiles are likely to trigger higher fees.

- Higher Minimum APRs for Unsecured Loans Than Some Competitors. Upstart’s minimum APR for unsecured loans currently sits above 7%. That’s higher than some competing branchless lenders. Even small rate discrepancies add up over time, so well-qualified borrowers may wish to shop around for the lowest possible rate.

- Only Two Term Options. Upstart has just two loan term options: 36 and 60 months. Traditional bank lenders may offer more flexible unsecured loan terms, while some branchless lenders, including Upgrade, offer credit lines with a wider range of term options.

- Limited, Confusing Help Portal. Upstart’s help portal isn’t particularly helpful or user-friendly. In my experience, its search function seems pretty picky and selective. For example, a search for “origination fees” returned zero hits, even though a standard-issue Google search for “Upstart origination fees” returned an Upstart help article mentioning origination fees. I’d recommend using your favorite search engine as a back door into Upstart’s help library unless the information you seek happens to appear among the handful of featured articles.

- Only One Core Credit Product. Upstart has just one core credit product: an unsecured personal loan funded by P2P investors. With a pretty wide variety of accepted uses, the product is versatile enough, but its structure and terms aren’t particularly flexible. Some competing lenders offer unsecured personal lines of credit, which are better for borrowers with short-term working capital needs. Most traditional bank lenders offer secured credit options as well, such as home equity lines of credit (HELOCs) for borrowers with sufficient equity in their homes.

- Not Available Everywhere. Upstart loans aren’t available in all states, and availability is subject to change over time.

How Upstart Stacks Up

Upstart is not the only online personal loan company in the world. It has dozens of competitors, many of which seem all but interchangeable with one another.

Subtle differences abound in this space though. Let’s drill down on how Upstart compares with one of its closest rivals, Payoff.

| Upstart | Payoff | |

| Loan Terms | 36 or 60 months | 24 to 60 months |

| Borrowing Limits | Up to $50,000 | Up to $40,000 |

| Loan Purpose | Virtually any legal purpose | Credit card consolidation |

| Origination Fees | Up to 8% | Up to 5% |

Final Word

Unlike some online-only competitors, Upstart is a P2P lender that uses individual investors’ funds to support its lending activities. The explosive growth of P2P lending this decade is just one example of the sharing economy’s power to fundamentally reshape how business is done.

The people-powered economic reordering isn’t over, not by a long shot. In the coming years, we can expect plenty of innovations that make P2P lending seem quaint. For now, let’s all celebrate just how easy it’s become to get a reasonably priced personal loan.

The Verdict

Upstart Personal Loans

Upstart Pros

- Inclusive underwriting process

- Rapid funding

- Potential for high borrowing limits

- No prepayment penalties

Upstart Cons

- Potential for high origination fees

- Only one core credit product

- Only two term options