Titan Invest

Titan Invest Pros

- Low cost compared to hedge funds

- No accreditation requirement

- Strong performance to date

Titan Invest Cons

- High-risk investment strategies

- High cost compared with robo-advisors

- $10,000 minimum for Opportunities

Created by Clayton Gardner, Joe Percoco, and Max Bernardy, Titan Invest is a platform designed to give the average investor the ability to follow a hedge fund-like investment strategy without having to manage their portfolios on their own.

Gardner — the CEO of Titan whose long list of credentials includes a history as a financial analyst for a hedge fund — and his team of investment advisors, analysts, and traders manage your portfolio for you.

The goal is to give you the upper hand in the stock market, regardless of whether you’re an accredited investor or not. Although Titan Invest is young, it is already building a history of compelling performance.

Key Features of Titan Invest

Titan Invest is quickly becoming a popular option among the investing community. The platform has already attracted more than $600 million in assets under management (AUM), which is impressive when you think about the fact that the company just launched in 2017.

These are the most important features of Titan Invest.

Aggressive Investment Style

The number one reason to consider investing with Titan is the sheer scale of returns the firm has generated for its customers. In 2020, even in the face of the COVID market crash, the firm delivered a 44.42% rate of return, outpacing the S&P 500’s 18.39% and the average robo-advisor return of 14.90% by a wide margin.

On an annualized basis, the company’s investment portfolio has generated 22.4% growth since inception. That’s more than double the long-term average return of the stock market.

Titan generates these returns through an aggressive investment style that’s focused on picking high quality individual stocks and using inverse exchange-traded funds (ETFs) for hedging.

When you sign up, a percentage of your assets is placed in the equities side of the portfolio. The remainder of your portfolio value is invested in inverse ETFs, acting as a personalized hedge. From there, you can either watch your money grow or make regular contributions to increase your earnings potential, leaving the legwork to the pros at Titan Invest.

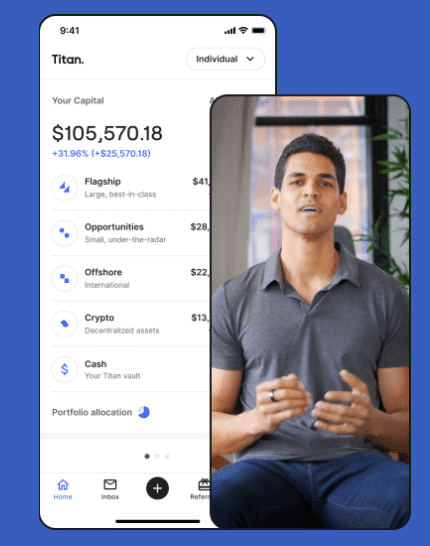

Five Portfolio Options

When you sign up, you’ll have the option to choose from five different portfolio styles. These include:

- Titan Flagship. The company’s Flagship portfolio invests in a small group of large-cap domestic stocks. The average market cap in the portfolio is around $500 billion, with stocks being chosen for their potential to beat the returns of the S&P 500.

- Titan Opportunities. The company’s Opportunities portfolio provides access to domestic small- and mid-cap stocks. The average market cap in the fund is about $9 billion, and stocks are chosen for their ability to provide exceptional returns. After all, small-cap stocks have a long history of outperforming their large-cap counterparts. However, for access to the Opportunities portfolio, you’ll need to maintain a minimum account balance of $10,000.

- Titan Offshore. The Titan Offshore portfolio gives you access to a select list of international stocks outside the U.S. in both developed and emerging markets. As with the Opportunities portfolio, the stocks are chosen based on their potential to deliver exceptional returns.

- Titan Crypto. Titan Crypto is an actively managed portfolio of crypto assets that are positioned well for strong long-run returns while offering minimal correlation to U.S. equities, making it a great option for hedging.

- ARK Venture Fund. Titan partnered with Cathy Wood’s ARK Invest to create the ARK Venture Fund. This is a big deal because it’s one of the first venture capital funds that’s available to non-accredited investors — who can invest in the fund for as little as $500.

Safety and Security

When deciding where you’re going to invest your money, safety should be a consideration. As technology becomes more sophisticated, hackers and con artists do too. So it’s important that no matter where you park your money, it’s both safe and insured.

All Titan investment accounts are covered by Securities Investor Protection Corporation (SIPC) insurance on balances up to $500,000. So, if your money becomes lost for any reason other than general losses in the stock market, you can rest assured that you’re covered.

All Titan accounts are held and cleared with APEX Clearing. APEX is one of the largest financial technology companies in the world, with a history of providing the tech necessary for the safe clearing of stock market transactions.

Finally, on Titan’s website, your information will be safeguarded by several layers of security. Titan uses an SSL connection with 256-bit encryption and a firewall to ensure the safety of your data.

User-Friendly Mobile App

Everything happens on the go these days, and the same is true when it comes to investing.

If you enjoy having on-the-go access to your investing accounts, you won’t be disappointed. The Titan Invest mobile app is intuitive and user friendly, offering everything you get when you log in to the platform on a desktop.

Multiple Account Types

Titan offers multiple account types. Whether you’re simply investing for the sake of investing or you’re building a retirement account, there’s an option available for you. The available account types include individual taxable brokerage accounts, traditional IRAs, and Roth IRAs.

Who Should Invest With Titan Invest?

There’s no such thing as a one-size-fits-all investing product. Everyone has different goals, a different risk tolerance, and different amounts of capital to put into the investing process. These factors make an investor a perfect fit for the Titan platform.

You Have $6,000 or More to Invest

With balances under $6,000, the fees you’re charged will work out to be more than 1% annually. That’s an expensive pill to swallow, and chances are that you’ll find better opportunities elsewhere.

You Have a High Risk Tolerance

Only investors with a healthy appetite for risk should ever consider an aggressive investing strategy that’s solely focused on investments in stocks. Risk-averse investors should consider other opportunities.

You Are Young

Due to the high risk associated with the Titan Invest strategies, younger people are the best candidates for this investing style. The younger you are, the more risk you can accept because you’ll have more time to recover should a significant drawdown take place.

Investors nearing retirement and others with short-term time horizons simply don’t have the time to recover from significant losses and should consider investing in a product or assets with limited volatility.

Private Credit & Real Estate Funds

Private credit and real estate funds are investments in private loans and real estate typically only available to institutional or accredited investors. Titan Invest recently announced it’s offering these investment products to retail investors too. Here’s some information on these funds:

- Private Credit. Titan has entered into agreements with global alternative asset managers who have led private credit funds that are available with lower minimums. You can access these funds with a $2,000 minimum investment, or $1,000 if you’re adding them to your IRA. These funds come with quarterly liquidity events — so, your money isn’t tied up for years like it would be in typical private credit investments.

- Real Estate. Titan has also opened a real estate fund with similar benefits to the private credit fund. Minimum investments are only $2,500 for individual accounts and $1,000 for IRAs. Titan Real Estate funds also come with quarterly liquidity events that allow you to tap into your investment dollars when you need to.

Advantages of Titan Invest

Considering the fact that so many investors are flocking toward Titan’s services, there’s obviously plenty to be excited about. Here are the biggest advantages to working with the firm:

- Low Cost Compared to Typical Hedge Funds. Hedge funds and other active investment managers generally charge performance fees. Sometimes, these fees can be as high as 20% of the profits earned. Compared to these funds, Titan’s 1% per year and $5 monthly fees are far easier to swallow.

- Not Just Available to Accredited Investors. Aggressive strategies that lead to gains that significantly outpace the market are typically only accessible by high net worth individuals and other big-money investors. The Titan Invest platform makes these exclusive returns available to the masses.

- Compelling Performance. Titan has only been around a few years, but in that time it has generated multiples of the average market returns. The potential to consistently and significantly outperform the market is very appealing to investors.

- Referral Program. Titan offers an opportunity to get rid of fees entirely and unlock the Titan Opportunities portfolio without the $10,000 minimum investment through its referral program. Refer two members and you’ll have access to the Opportunities portfolio with a minimum investment of $100. Refer four new members and you’ll get rid of your advisory fees entirely. Even if you only refer one person to the platform, you’ll enjoy a 25-basis-point (0.25%) reduction in your annual fee.

Disadvantages of Titan Invest

So far, Titan may seem like a platform built of sunshine and rainbows. But there are some dark clouds in the sky to consider too.

- High Risk. The strategies used by the pros at Titan Invest are high-risk/high-reward strategies. Without the use of fixed-income investments and heavy diversification, conservative investors with a low risk tolerance or investors with a short time horizon who can’t afford to absorb market downturns will find the volatility associated with the strategy to be a turnoff.

- High Cost Compared to Robo-Advisors. While there are no performance fees, investing with Titan is more expensive than the average robo-advisor. For example, Betterment charges a management fee of 0.25% per year, which makes 1% seem like an exorbitantly high fee. For smaller accounts, $5 per month can actually be pretty pricey. To put it into perspective, if you have a $500 starting balance, $5 per month works out to annual fees of 12%.

- Account Minimums. All Titan accounts have a $100 minimum investment, which isn’t a big deal. However, if you want access to the Opportunities portfolio, you’ll need to maintain a minimum balance of $10,000, which is too high for some investors.

- Lacks Additional Features. Titan Invest doesn’t offer tax-loss harvesting, financial advisors, or financial planning, all of which are generally available when working with the company’s competitors.

How Titan Invest Stacks Up

Titan Invest has a unique business model that merges the high-risk, high-reward strategies of a hedge fund with the convenience of a robo-advisor — and without the high investment minimums of the former. Here’s how it stacks up against Betterment, perhaps its most popular competitor.

| Titan Invest | Betterment | |

| Minimum to Invest | $100 for Titan Flagship, $10,000 for Titan Opportunities | $0 |

| Advisory Fee | 1% AUM plus $5 per month | 0.25% to 0.40% AUM |

| Performance | Significantly better than the S&P 500 | Similar to the S&P 500 |

| Banking Features | None | Checking and Savings |

Final Word

All told, the Titan Invest platform is a great option for the audience it was designed to serve. Young investors with a high risk appetite will benefit greatly from the firm’s aggressive investment strategies.

Regardless of your age, it’s important to keep a sizable balance in your account if you’re going to use Titan to ensure that fees don’t eat into too much of your profits.

On the other hand, if you’re not a young investor or don’t have a healthy appetite for risk, it’s likely best to look into low-cost, highly diversified ETFs and choose an asset allocation that fits your investing goals and timeline. Also, it won’t hurt to mix some fixed-income assets in to further shield your portfolio from volatility.

The Verdict

Titan Invest

Titan Invest Pros

- Low cost compared to hedge funds

- No accreditation requirement

- Strong performance to date

Titan Invest Cons

- High-risk investment strategies

- High cost compared with robo-advisors

- $10,000 minimum for the Opportunities portfolio