Regardless of your income or net worth, anxiety is a common response to handling finances. Whether it be daily problems or long-term concerns, many people have a complicated relationship with money.

A 2020 survey revealed that 90% of individuals say that money has an impact on their stress levels. And, in a time of great economic hardship during the COVID-19 pandemic, money anxiety can heighten even further. If we look back to a study conducted by the APA to understand the impact of stress during the 2008 recession, 80% of respondents said that the economy was a significant cause of stress.

We reached out to clinical psychologists and financial experts to learn unique, actionable advice for Americans to cope with money anxiety during the recession. Find out what they had to say.

Click here to skip to the infographic.

1. Identify How Your Money Anxiety Is Affecting You

If you’re showing signs of anxiety over your finances, you’re not alone. The first step to learning how to cope with money anxiety is by acknowledging it.

According to the National Institute of Mental Health (NIH), anxiety can cause restlessness, fatigue, difficulty concentrating, muscle tension and sleep problems. The stress that stems from money anxiety can also trigger self-destructive financial behaviors, so it’s first important to ask yourself — do I have money anxiety?

- Spending causes stress. Whether you’re underspending or overspending, you feel stressed every time you spend money. And if you overspend, you feel remorseful and depressed after your shopping spree.

- Debt is a source of anxiety. Even when your debt payments are manageable and warranted, you constantly worry about the amount of debt you have.

- You don’t discuss finances. You steer clear from talking about finances in any form with family, friends or even your significant other.

- You can’t change your behaviors. No matter how many times you try to change your spending and saving habits, you never reach your goals.

There are different conditions that can develop in a response to money anxiety such as compulsive buying disorder, compulsive hoarding disorder, pathological gambling and more. If you think your money anxiety has caused unusual behavior, don’t be afraid to consult with a psychologist — many of whom are available via video chat or phone.

2. Recognize Your Financial Accomplishments

Chances are that you’ve reached personal financial accomplishments whether they be small or big. That could be paying off credit card debt, earning a raise at work, increasing your credit score, making your monthly payments on time, contributing to a 401K or even cooking at home more often to save on take-out costs.

Make a list of your accomplishments and reflect on them. What are you most proud of?

Focusing on what you’ve done right will help steer your mindset in the right direction. Always know you can earn those feelings again.

3. Create a Budget (And Stick to It)

If you are in control of your finances, the anxiety surrounding it can subside. We asked Allison Baggerly of Inspired Budget and she was sure of one way to alleviate stress — focus on the facts.

Solidify your budget in a spreadsheet, a budgeting tool or any way you feel comfortable to hold yourself accountable. Identify your financial situation by asking yourself these three questions.

What do you have? — savings account, investments, retirement accounts and more.

What do you owe? — credit card debt, student loan, auto loan, mortgage loan and more.

What’s coming in and out? — Determine income and expenses.

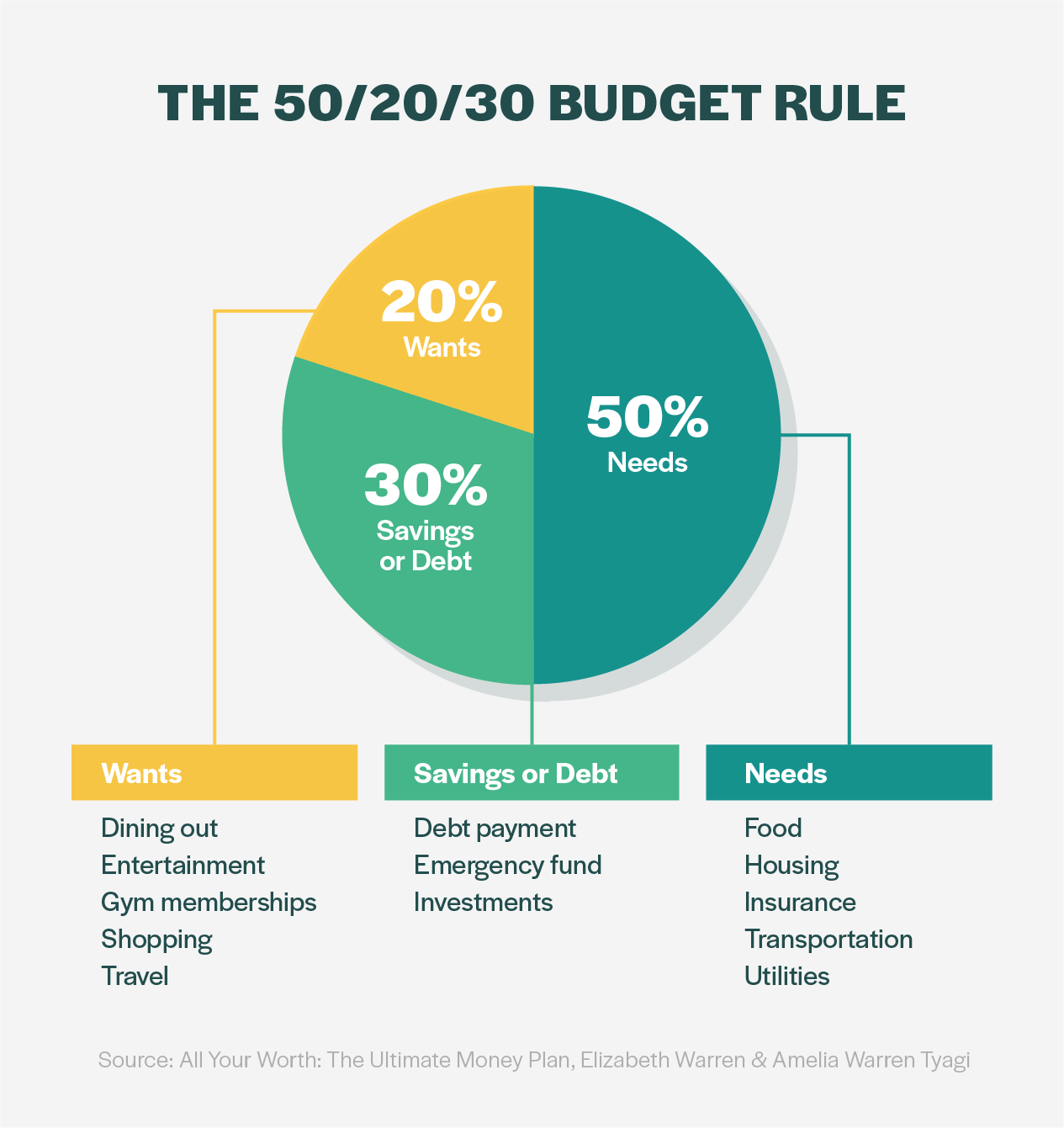

Even if your income has changed due to the pandemic, these questions will help you understand your finances on paper. From here, create a budget that’s sustainable with your lifestyle. In Elizabeth Warren’s book “All Your Worth: The Ultimate Lifetime Money Plan,” she recommends using the 50/20/30 rule in budgeting your monthly income. That is, 50% on things you need, 30% on things you want and 20% on building your savings or paying down debt.

Even if you don’t have the resources to contribute to savings or paying off debt, come up with a budget in which you can allocate your wants differently during the crisis and post-crisis. Developing a spending and savings plan will help alleviate some of the anxiety you have over finances both now and in the future.

4. Identify What You Have Control Over

You have control over your discretionary spending. Know where to cut expenses.

Look into your auto-billed subscriptions, cheaper alternatives to your phone and cable plan, insurance policies and more. Even if you can cut $100 per month in spending, that amounts to $1,200 per year. Your short-term cuts can help achieve your long-term goals.

Determine how much you spend on each expense, organize it by priority and then compare it to how much you allocated to discretionary spending in your budget. Even if temporary, are you able to make cuts in gym memberships, cable TV, take-out, beauty products, music lessons or other less essential expenses?

5. Ask for Relief

It’s normal to experience a spike in anxiety if there’s a decrease in your income, especially if that makes it difficult to pay your bills. That’s especially relevant today as more than 36 million Americans have sought out unemployment benefits since the coronavirus hit the U.S.

Luckily, credit card issuers and lenders have stepped up to offer relief during the financial hardship. Contact your issuers to learn more about assistance efforts and your eligibility. Some examples include debt relief, payment deferrals, no late payment fees and reduced interest rates.

Oftentimes relief is granted on a case-by-case basis, so even if you don’t see your issuers share a public change to their policies, it’s possible that you can still be granted relief based on your situation.

6. Focus on Your Goals

In a recent study on financial goal setting and financial anxiety, researchers found that Solution-Focused Financial Therapy (SFFT), a financial goal setting session to reduce anxiety levels over finances, was successful at least in the short-term. This approach helps people struggling with money anxiety realize their talents and focus on goals versus past failures.

It’s easy to focus on a loss of income, a misjudged investment or that time you tapped into your savings. But, that won’t help ease your anxiety or move forward.

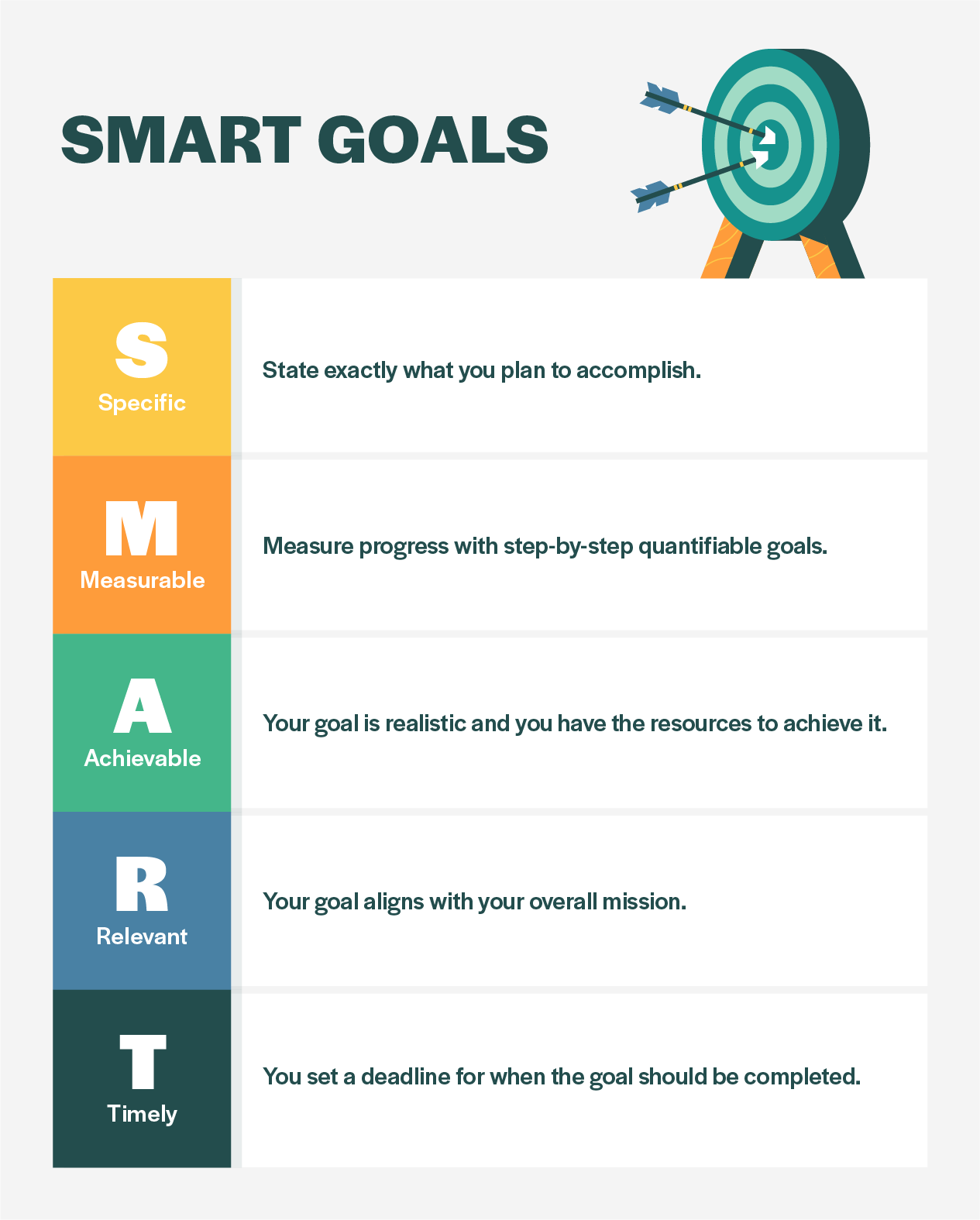

Instead, create long-term goals that will keep you motivated and on track. Set SMART goals, which will allow you to productively focus your time and effort to accomplish your long-term goals.

These can be smaller wins like automatically saving $100 per paycheck. Or, larger goals such as paying off your student loan debt in five years through a detailed plan.

Whatever it may be, consider how your actions can turn into something positive in the long run.

7. Limit Outside Noise

It’s easy to feel consumed by the constant reporting of the economy, especially during the COVID-19 era. In the same vein, it can feel hard to avoid comparing yourself to your friends or influencers on social media.

Try to limit that outside noise by putting a cap on the time you spend watching or reading the news, or on social media. If you’re having a hard time sticking to your limits, you can use tools like RescueTime or built in apps like iOS Screen Time. Or, it could be as simple as turning your notifications off or on silent.

By setting limits, you can not only help ease anxiety, but put more emphasis and time into something that will fulfill you.

8. Focus on the Long Term

Marathon training takes time. There are good days and bad days, but it’s all worth it to eventually cross the finish line on the race day.

The same goes for your investments.

Instead of thinking about daily changes such as, “I lost $20,000 in the market today,” consider where your investments could be in the future, such as three or more years down the line when the markets recover.

Focusing on your long-term strategy will help ease money anxiety when investing in your future.

9. Ask for Help

It’s normal to keep your finances private.

Sure, it’s common to discuss the overwhelming student loan debt in the U.S., but not many people come out and reveal, “I have $100,000 in student loan debt.” Many of those people stay silent for the fear of judgement.

Just because you want to keep money-related issues private doesn’t mean you need to suffer alone. The more you’re able to talk to someone else about it, the better you’ll feel. Find someone to confide in to help ease your money anxiety.

Seek professional help. If your money anxiety is turning into a bigger health problem, a clinical psychologist can help you cope.

Join a support group. There are many support groups to combat anxiety both online and in local communities. Join one that will make you feel comfortable with sharing your money anxiety.

Confide in a family member or friend. Reach out to a trusted family member or friend to talk through your money anxiety. Sometimes just saying what’s going on in your life can help ease your anxiety.

Find an accountability partner. Accountability is key in sticking to your budget. Whether it’s a spouse, trusted friend or relative, work with someone to help you stay on top of your financial progress.

10. Look at the Bigger Picture

Accept that you can’t change things quickly. Shift your attention to the part of your life that you do have control over. Take action there.

Focus on other aspects of life that you’re thankful for — whether that be family, health, work, freedom, pets or anything else that makes you happy. Taking your focus from your finances to the finer things in life can help ease your anxiety.

Learn more actionable tips through our visual below.

Sources: GOBankingRates | NCBI | APA | Dr. Dan Pallesen | Dr. Joy Lere | Benjamin Hayes, Wipfli Financial | Inspired Budget