Pros

Solid savings and CD yields

Savings accounts come with ATM card

Relatively low fees

Cons

No checking account

No auto or home loans

No brokerage or securities

Synchrony Bank is one of the newer online banking options for U.S. consumers. It came into existence in mid-2014 when it changed its name from GE Capital Retail Bank.

Synchrony Bank boasts FDIC-insured savings, money market, and CD accounts, all with attractive yields (competitive rates) and relatively few hoops to jump through.

Its CDs and money markets can be structured as traditional and Roth IRAs, boosting the bank’s appeal to retirement savers. All accounts come with FDIC insurance on balances up to $250,000.

Key Features of Synchrony Bank

Synchrony Bank has some other features worth noting, including a loyalty rewards program that provides high-deposit and longtime customers with travel discounts, priority customer service, special account rates, and other perks.

Although it doesn’t make direct loans, its Synchrony Financial affiliate provides financing services and private-label credit cards for dozens of U.S. retailers and their customers. Synchrony itself offers three Mastercard credit cards with rewards programs and other perks.

Synchrony Bank has one noteworthy drawback: It doesn’t offer a checking account. If you’re looking for juicy new checking account promotions and offers, you’ll want to look to one of Synchrony’s fine competitors.

High-Yield Savings Account

The Synchrony high-yield savings account yields 4.75% APY on all balances. That’s significantly higher than the national average for branch-based and online savings accounts, according to Synchrony Bank.

There’s no minimum opening deposit or monthly maintenance fee. You can request a free ATM card at account opening, but it’s not essential. Virtually all U.S. ATMs are fair game for withdrawal, and Synchrony doesn’t charge its own ATM fees.

However, ATM withdrawals are capped at $1,000 per day — a bit tight considering Synchrony doesn’t have any physical branches with withdrawal counters. Third-party ATM fees are refunded up to $5 per month.

You’re limited to just six withdrawals from savings (and money market) accounts per month at Synchrony. Although Synchrony doesn’t charge a fee for excessive withdrawals, exceeding the limit is grounds to close your account for misuse.

Money Market Account

Synchrony’s money market account yields 2.25% APY on all balances and doesn’t have an opening deposit requirement or ongoing monthly fee.

All accounts come with a free book of checks and a free, optional ATM card. The same withdrawal limits and ATM reimbursement rules apply here.

Certificates of Deposit (CDs)

Synchrony’s CD terms range from three to 60 months. There are nine options in all, making it easy to create multi-CD ladders here:

- 3-month

- 6-month

- 9-month

- 12-month

- 18-month

- 24-month

- 36-month

- 48-month

- 60-month

Synchrony CDs follow a tiered interest rate structure with steps at $25,000 and $100,000. Yields range from 2.25% APY on the 3-month CD to 4.00% APY for the 60-month CD.

All CDs come with a 15-day best rate guarantee that automatically entitles you to the highest available CD interest rate within the first 15 days of opening your account.

There’s no minimum balance required to open a CD with Synchrony. For CDs with terms under 12 months, the early withdrawal penalty is equivalent to three months’ interest. For longer terms, the penalty is six months’ interest.

Special CDs

Synchrony offers two types of special CDs: Bump Up and No Penalty.

The Bump Up CD is a 24-month product that lets you raise your rate once during the term if Synchrony’s CD rates rise. You can raise your rate at any point as long as you haven’t used up your allowance.

The No-Penalty CD is an 11-month product that doesn’t have an early withdrawal penalty. You can withdraw funds from the CD at any point or close it out entirely without sacrificing any interest.

Individual Retirement Account (IRA) Options

For retirement savers who want to reduce the tax burden on their long-term savings, Synchrony Bank offers special money market and CD accounts that can be structured as traditional IRAs or Roth IRAs.

Unless otherwise noted on Synchrony’s website, these IRA options’ term lengths, yields, yield tiers, opening deposit requirements, and early withdrawal penalties are identical to their non-IRA counterparts.

Trust Accounts

Any Synchrony account type can be designated as a revocable or irrevocable trust.

Revocable trusts can be altered by the grantor, beneficiaries, and anyone with power of attorney. Trust funds are a common use case.

Irrevocable trusts can only be altered by the beneficiary. For more information, check out Synchrony Bank’s forms page.

Third-Party Financing Through Synchrony Financial

Although Synchrony Bank doesn’t directly issue credit cards or loans, it does provide financing and credit services for a wide range of well-known businesses in the United States.

The bank specializes in financing big-ticket purchases, such as new HVAC equipment and jewelry, and issuing private-label credit cards that can be used at specific retailers.

You can find a list of businesses that offer Synchrony-backed financing at the website for Synchrony Financial, a Synchrony Bank affiliate.

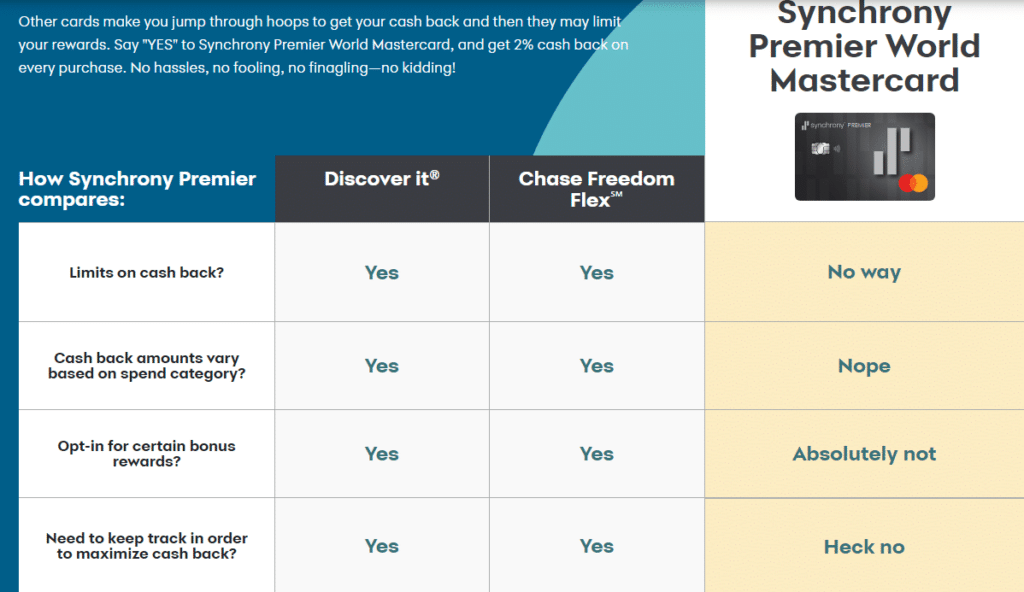

Synchrony Credit Cards

Synchrony issues three Mastercard credit cards:

- Synchrony Preferred Mastercard. This is a no-annual-fee credit card with Mastercard-backed perks like identity theft protection. It doesn’t have a rewards program, however.

- Synchrony Plus Mastercard. This no-annual-fee rewards credit card promises 1% unlimited cash back on every eligible purchase and a slew of Mastercard-backed benefits, including cellphone protection and credits with partner merchants like Lyft, Instacart, and Hello Fresh. The World Elite Mastercard benefits and offers page has more details.

- Synchrony Premier Mastercard. This no-annual-fee card pays 2% cash back on all eligible purchases with no caps or restrictions and boasts the same great perks as Synchrony Plus. The catch: It’s reserved for applicants with excellent credit scores.

Customer Support

Synchrony Bank’s customer support apparatus includes a general-purpose email address, internal messaging system for registered account holders, and a toll-free phone hotline. Automated banking services, such as balance checks, are available 24/7 through the hotline.

To speak with a human representative, you need to call during extended Eastern Time business hours Monday through Friday, or during regular Eastern Time business hours on Saturday.

Advantages of Synchrony Bank

These are some of the arguments in favor of banking with Synchrony Bank. Among the most powerful are the high yields, low minimums, and excess withdrawal fee waivers.

- Excellent CD Rates. Yields on Synchrony Bank’s CDs range up to 4.00% APY for the 60-month product. That compares favorably to well-known online banks such as Ally Bank. And it blows many smaller online banks’ yields out of the water.

- Solid Savings Yields. Synchrony Bank’s 4.75% savings yield exceeds that of many competing online banks. That makes this account a good place to park your extra cash while deciding what to do with it.

- Few Restrictions on Savings and Money Market Accounts. Synchrony Bank’s money market and savings accounts come with relatively little red tape. There’s no minimum deposit requirement or ongoing minimum balance requirement on either, for instance. Other savings and money market accounts come with more inconvenient restrictions, such as the iGoBanking money market’s prohibitively high $25,000 minimum opening deposit and ongoing balance requirement.

- ATM Card Available With Savings Account. Synchrony Bank’s savings account comes with a rare perk: a free, optional ATM card. Since you can’t open a checking account with Synchrony, this perk makes it easier to tap your savings for cash if you don’t have available funds in another account, such as a Synchrony money market or another bank’s checking account. Many other online banks, including Ally and FNBO Direct, do not offer ATM cards with savings accounts.

- No Account Management or Maintenance Fees. Synchrony Bank doesn’t charge account management or maintenance fees, even when balances are minimal. This is a big advantage over some traditional banks, which require hefty minimum balances to avoid monthly maintenance fees.

- No Fees for Excess Withdrawals. Although withdrawals from Synchrony savings and money market accounts are technically capped at six per month by law, Synchrony is in a distinct minority of consumer banks that don’t levy excess withdrawal penalties on customers who exceed the cap. You can make more than six savings withdrawals or outbound transfers per month without incurring any charges, although Synchrony reserves the right to close your account if you abuse the privilege.

- ATM Reimbursement Up to $5 Per Month. Synchrony Bank reimburses third-party ATM fees up to a $5 monthly limit. That’s not a huge break, but it’s a help for people who don’t need cash every day.

- Better Customer Service Availability Than Some Competitors. Synchrony Bank’s customer service representatives are available from 8am to 10pm Monday through Friday, and from 8am to 5pm on Saturday. Those windows are longer than similarly sized online banks, such as BankDirect or Salem Five Direct. It’s particularly nice to be able to get in touch after hours, because many people can’t afford to take time away from work to speak with their bank.

- IRA Options’ Yields Are Identical to Non-IRA Equivalents. Synchrony Bank’s IRA money markets and CDs have identical yields — and, in the CDs’ case, term lengths — as their non-IRA counterparts. This sounds like a no-brainer, but many online banks offer IRA CDs and money markets at much lower yields than comparable non-IRA instruments, rendering them much less attractive than they’d otherwise be.

Disadvantages of Synchrony Bank

These are Synchrony Bank’s most important drawbacks. They include a lack of day-to-day money management options (checking accounts) and installment loans.

- No Checking Account. Synchrony Bank’s single biggest drawback is its lack of a checking account. Practically speaking, this omission makes it impossible to use Synchrony Bank for your day-to-day financial needs, as savings and money market withdrawals are limited to six per statement period. A number of other online banks — even smaller ones, such as Salem Five Direct and BankDirect — tend to offer a checking option.

- No Auto or Home Loans. Although Synchrony Bank offers third-party financing and private-label credit cards through its affiliate Synchrony Financial, it doesn’t make direct loans or issue credit cards that can be used without restriction. If you want an online bank that offers auto or home loans, you’re better off with a well-known competitor, such as Ally Bank (auto) or Capital One 360 (home). For in-house credit card options, look to FNBO Direct (Visa ExtraEarnings credit card) or Discover Bank, whose parent company offers numerous credit card options.

- No Business Products. Synchrony Bank doesn’t offer any accounts or credit products for business customers. If you’re looking for a small-business loan or credit card, try a more specialized online business financing option. Or, if you’re looking for business bank accounts, TIAA Bank offers a full lineup.

- No Investment Products. Synchrony Bank doesn’t have an in-house brokerage, nor any true investment options (fixed-interest IRA CDs don’t count). Some competing online banks have affiliated brokerages or mutual fund families, such as Ally Invest.

How Synchrony Bank Stacks Up

Synchrony Bank has a lot of competition in the online banking space. Let’s see how it compares to one of the best in the business: Ally Bank.

| Synchrony Bank | Ally Bank | |

| Savings Yield | 4.75% | 4.25% |

| CD Yields | Up to 4.00% | Up to 4.10% |

| Checking Account | No | Yes |

| Brokerage | No | Yes |

Final Word

Not every bank can be everything to everyone. Some that aren’t everything to everyone try to pretend that they are, with predictable consequences for customer satisfaction and retention.

Fortunately, Synchrony Bank doesn’t pretend to be anything it’s not. It does what it can to support customers who appreciate its attractive savings vehicles, even offering a pretty nifty loyalty program that rewards longtime account holders. But it never makes any representation that it’s adequate for day-to-day banking or borrowing needs.

If you’re looking for straight talk from your online bank, you could do worse than Synchrony.

Pros

Solid savings and CD yields

Savings accounts come with ATM card

Relatively low fees

Cons

No checking account

No auto or home loans

No brokerage or securities