Landing your first career-track job is cause for celebration. Before you start planning for your first day on the job, take an evening or weekend to revel in your accomplishment. You deserve it. What must come next will not be as fun, but it’s crucial to your long-term financial position. Your first “real” job is

You searched for

Early 401k Withdrawals

9 articles

The rich really do have better investment opportunities than the rest of us. I remember the first time my money was turned down when I went to invest. I approached a hard money lender I knew personally, who I knew to have an excellent track record with his firm’s loans. “I’m sorry,” he said. “I

Given sufficient time to prepare, humans anticipate and plan pretty well for planned life events, such as marriage, childbearing, and retirement. However, it’s difficult for most people to imagine – let alone prepare for – major, unexpected life changes. Serious illnesses and injuries befall millions of Americans each year, often with little or no warning. Most working adults

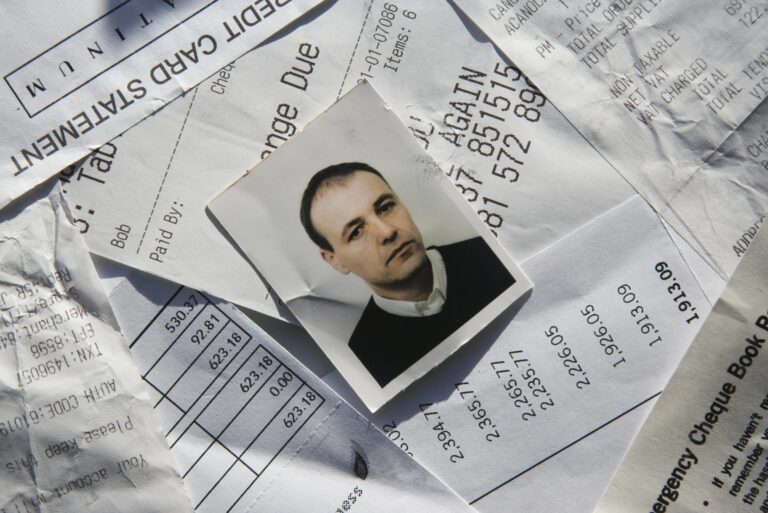

Have you ever been a victim of identity theft, or do you know someone who has? Chances are, you can answer yes to at least one of those questions. Identity (ID) theft is rising at an alarming rate. According to research conducted by Javelin Strategy, an independent research firm, identity theft rose by 8% in

In 2017, more than 676,500 American homes went into foreclosure, according to Attom Data Solutions. That’s roughly 1 out of every 200 homes in the country. This is better than the peak rate in 2010 when more than 2 out of every 100 homes were in foreclosure, but it still represents hundreds of thousands of people being

Country wisdom is the collection of practical experiences gained by generations of pioneers, farmers, and ranchers as America transformed from a vast frontier to the world’s greatest economy. That experience – the result of constant trial and error – was passed from parent to child in plain language that left no room for misinterpretation. Living

According to an August 2014 report from Bankrate, more than one-third (36%) of American adults are not currently saving for retirement. Worse yet, more than a quarter of Americans nearing retirement age (50 to 64 years old) have yet to save anything. While the stats are staggering, they’re somewhat understandable – it’s easy to de-prioritize

While saving for retirement is important, there are times when it makes sense to delay making investments. Most people invest for retirement in a tax-advantaged plan such as an IRA or 401k with early withdrawal penalties and adverse income tax consequences. While these vehicles provide tax-advantaged growth that help your money grow, they can wreak

Whether your retirement is fast approaching or decades away, it is likely that you do not spend much time pondering what will happen when you stop working. Unfortunately, many people are unable to retire when they’d like to because of their financial situation. With careful planning, you can avoid this predicament. Planning ahead for retirement allows