Insurance

12 articles

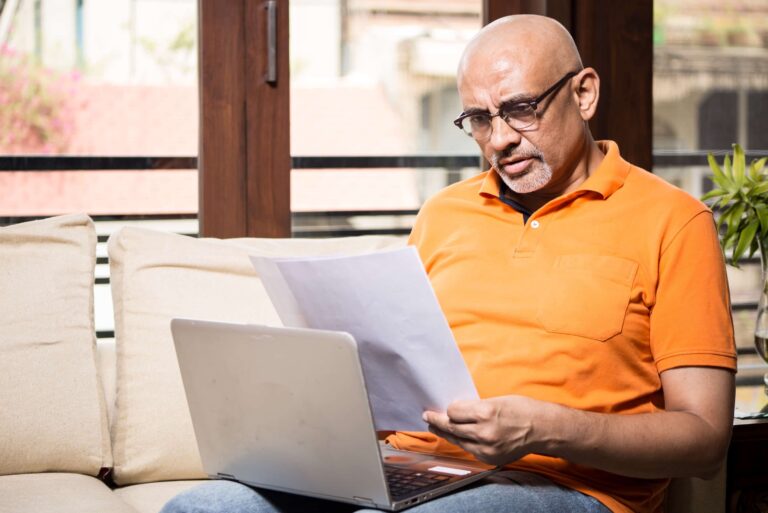

A denial letter isn’t the end of story for a health insurance claim. If you’re persistent and file a proper appeal, you could get that claim paid after all, at least in part.

Gerber Life Insurance is a natural fit for your life insurance short list, whether you need insurance for your child or yourself. But it’s not the only option out there, even for infants and children, so review its options and features carefully before buying.

The median home price in the United States hovers around $200,000, which means your home is the biggest investment you’ll likely make in your life. The purpose of homeowner’s insurance is to protect that investment should it be damaged or destroyed. That said, it’s pretty important. However, protecting such a big investment doesn’t have to

It’s human nature to wish for a long, happy life. Sadly, that’s not in the cards for everyone. Term life insurance can be there financially for your family if you aren’t. To determine whether it’s right for you, learn how it works, who needs it, and when it’s just not worth the cost.

Whole life insurance is a type of permanent life insurance contract that covers you until you die or reach 100 years of age, whichever comes first, and usually accumulates value for policyholders. Learn about whole life insurance, its key features, its pros and cons, and whether it’s right for you.

What would your loved ones do if you died tomorrow? They’d probably need to make some changes unless you left them with financial protection. That’s where life insurance comes in.

If you’re a millennial, it can be tough to know whether to buy life insurance. All you can do is familiarize yourself with these pros and cons and decide what’s best for you.

Have you ever committed insurance fraud? Are you sure? The definition is really broad, and the penalties can be stiff. Find out what insurance fraud is and how it affects you.

Collision coverage can significantly reduce out-of-pocket auto repair in some situations. But before you buy, determine whether collision insurance makes sense for you.

How much life insurance do you need? It’s a hard question to answer because the answer isn’t constant over an entire lifespan. But because life insurance is cheaper when you’re young and healthy, mapping out your long-term life insurance needs now is essential. And it’s easier than you think.

Renters insurance has several benefits for tenants. And some property owners require tenants to carry it. But it comes at a cost. Before rushing to purchase a policy you might not need or writing off renters insurance as unnecessary, take a few minutes to consider the benefits and drawbacks.

Health care consumers can turn to two similar but distinct supplemental plans — flexible spending accounts and health savings accounts — to cover costs not covered by insurance. But it’s essential you understand the differences and determine which is best for your needs.

Trending stories

Explore Protect Money

You don’t want to lose it. Learn how to keep it safe.