Lending Club

- Loan Types: Personal (unsecured), business (unsecured), medical, auto refinancing

- Loan Terms: 3 or 5 years for personal loans; 1 to 5 years for business loans; 2 to 7 years for medical loans; 2 years or longer for auto refinancing loans

- Loan Size: $1,000 to $40,000 for personal loans; $5,000 to $300,000 for business loans; $499 to $50,000 for medical loans; $5,000 to $55,000 for auto refinancing loans

- Rates: 6.16% to 35.89% APR for personal loans; 5.99% to 35.71% APR for business loans; 3.99% to 26.99% APR for medical loans; 2.24% to 24.99% APR for auto refinancing loans (all rates subject to change)

- Origination Fee: 1% to 6%, depending on loan size, term, and borrower profile

- Minimum Investment: $1,000

Lending Club bills itself as the world’s most popular peer-to-peer (P2P) lending network. As a classic example of the emerging sharing economy, the platform connects thousands of individual and business borrowers with regular people willing to fund their loans. In doing so, it eliminates the need for borrowers to approach traditional banks and credit unions – whose lending standards may be much more stringent than Lending Club’s – to obtain financing. Lending Club accepts borrowers with all sorts of motivations, from debt consolidation and credit card refinancing to funding a down payment on a house and covering unexpected medical expenses.

For investors, Lending Club offers the opportunity to create diversified portfolios that aren’t directly tied to bond markets. Its investments offer better yields than CDs, money market accounts, and savings accounts, though it’s critical to note that the investments are not FDIC-insured.

What Is Lending Club?

Lending Club competes with other P2P lending platforms, including Prosper and Peerform, as well as online direct lenders like Avant (which doesn’t follow the P2P model) and alternative business lenders (also not P2P) such as OnDeck and Kabbage. Its original business line is unsecured personal loans for individuals. It also offers unsecured loans to business owners and two niche products: medical loans and auto refinancing loans.

Lending Club’s individual loans range from $1,000 to $40,000 principal and have terms of 3 or 5 years. Borrower interest rates range from 6.16% APR to 35.89% APR, depending on credit score, credit history, and past borrowing record with Lending Club. Lending Club doesn’t tie its rates to an index such as Libor, but it advises that rates may rise or fall depending on “market conditions” – in other words, prevailing interest rates.

Lending Club’s business loans and lines of credit with terms of 1 to 5 years and principals of $5,000 to $300,000. Business products’ annualized interest rates range from 5.99% APR to about 36% APR, though they’re subject to change with prevailing rates and other market conditions.

See the Key Features section for more details about Lending Club’s niche products, which aren’t as popular as its unsecured personal and business loans.

How It Works for Investors

As a Lending Club investor, you can view Notes, or shares of unfunded loans that can be reserved for possible investment. You can reserve Notes in increments as low as $25. It’s important to note that Notes represent shares in first-issue loans that haven’t yet been funded, not already-funded instruments on a secondary market. Some Lending Club loans don’t receive enough funding to originate. If you reserve Notes in a loan that doesn’t originate, you don’t lose anything – you just get your money back to allocate to Notes in other loans.

Loan Performance

The $25-per-loan investment threshold makes it easier to create a diversified loan portfolio with a relatively modest investment. According to Lending Club’s historical data, investors with diversified loan portfolios (exposure to 100 or more loans and a mix of business and individual loans) can expect to earn annual returns between 4% and 6%. For what it’s worth, these projected returns have declined slightly over time.

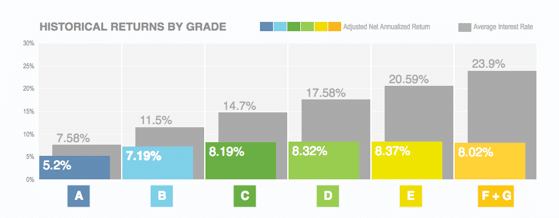

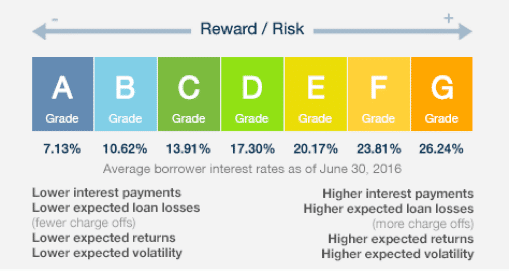

As a general rule, annualized default rates vary inversely with loan grade: the higher the loan grade, the lower the default rate. Over time, default rate trends depend on economic conditions, Lending Club’s underwriting standards, and other factors.

These default rates are subject to change over time, and it’s important to note that loans with higher yields come with a greater risk of default compared to loans with lower yields. When you look at an individual loan’s listing, you’ll see its estimated default risk, making your risk calculation that much easier.

While Lending Club stresses that 99.9% of diversified loan portfolios produce positive annual returns on a consistent basis, you do risk loss of principal when investing here due to lack of deposit or investment insurance. These risks may be higher during economic downturns, when default rates are likely to increase. As always, remember that past performance is not predictive of future results.

Manually Selecting Loans and Investing

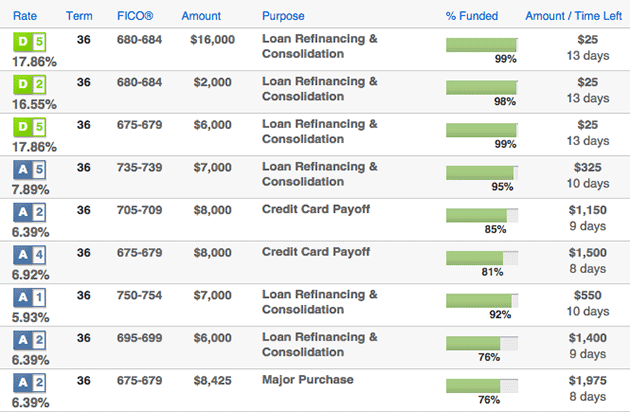

If you want to evaluate each loan you ultimately invest in, you can manually browse through loan listings. To narrow your choices, filter by such criteria as loan purpose, loan grade, borrower credit score, loan size, time left, rate, and term. When you view an individual loan’s listing, you see detailed information about the loan, including all of the filtering criteria, as well as the monthly payment, funding percentage, and number of investors currently funding.

Listings also contain information about the borrower, including his or her credit score, Lending Club grade, credit history, income, employment status, and homeowner status. And if the borrower chooses, he or she can write a detailed personal statement and loan description. You can’t change settings so that you only view personal or business loan listings at any given time, but each loan’s heading (“Personal” or “Business”) makes it easy to distinguish between the two types.

If a particular loan’s listing meets your investment criteria, you can select how many $25 Notes you want to buy and transfer funds from your Lending Club account. If your loan isn’t funded, you’ll find out within 14 days (or before, depending on when the listing expires). Funds earmarked for loans that don’t originate are returned to your account, where they become available for new investments.

These procedures are subject to change, so be sure to familiarize yourself with Lending Club’s loan origination process before you invest.

Automated Screening and Investing

If you don’t have the time or patience to manually screen loans, Lending Club has an automatic screening and investing tool that allows you to quickly invest in dozens of loans without approving each one.

The process is simple: You set a lower limit on the loan grades you’re willing to accept, and Lending Club uses the cash in your account to make equal-sized investments in each new loan that’s above that limit. For instance, you can choose to only invest in loans graded A and B, or expand to include loans down to F or G, the lowest rating. If you want more control over the process, you can manually set your desired interest rate range, such as 10% to 15%.

Lending Club’s automatic investing tool isn’t instantaneous. The speed at which it invests your account’s cash depends on the availability of loans that meet your criteria and the relative amount of cash in your account. Lending Club prioritizes investments for accounts with more cash, so if you have a small balance, you may find yourself at the end of the line. Likewise, if you have narrow criteria – such as only accepting loans graded A or B – you may have to wait days or even weeks to be fully invested due to a lack of supply of suitable loans.

Receiving Funds

Lending Club investors receive payments at any time of the month, usually within three business days of debiting from the borrower’s bank account. Your payment is proportional to your total stake in the loan, less a 1% annual service charge. In other words, if you invest $500 in a loan with a 10% interest rate, your effective yield is 9% APY, which is $45 annually or $3.75 per month. Prosper and Peerform also take a 1% service charge for each loan issued. You also receive a proportional amount of any late fees charged to a borrower’s account, if they’re ever paid.

Eligibility

To invest with Lending Club, you need to be at least 18 years old, have a valid Social Security number, and meet other financial criteria depending on your state of residence.

Lending Club accepts investments from residents of most states. The exact list varies over time, so check with Lending Club directly for up-to-the-minute information.

Most lenders need to meet strict financial criteria: Either gross annual income of at least $70,000 and a total net worth (not including real estate, home furnishings, and automobiles) of at least $70,000, or a total net worth (with the same restrictions) of at least $250,000. California residents must have gross annual incomes of at least $85,000 and total net worth of at least $85,000, or a total net worth of at least $200,000.

These requirements are waived for California residents who invest less than $2,500 or 10% of their net worth, whichever is less. In fact, regardless of where you live, you can’t invest more than 10% of your net worth at Lending Club.

Application

To apply for a Lending Club investor account, you need to provide your current contact information, Social Security number, and bank account information (for making deposits and withdrawals into and out of your Lending Club account). Lending Club uses the information you provide to verify your identity and bank account, a process that typically takes one to three business days.

Once approved, you need to deposit at least $1,000 to fund your account. The minimum investment per note is $25. You can’t buy Notes unless you have sufficient funds in your Lending Club account. To ensure that’s never a problem, consider setting up automatic deposits from your tied bank account in the amount and frequency of your choosing.

How It Works for Borrowers

Here’s a look at how the borrowing process works for individuals and business owners. See the Key Features section for details on Lending Club’s two niche products.

Loan Characteristics and Restrictions

If Lending Club chooses to approve your application, it assigns a loan grade – measuring the likelihood that you’ll default on the loan – and interest rate to your loan. Loan grades include a letter (A – G) and number (1 – 5).

Individual borrowers rated A1, the highest-quality grade, can expect interest rates of around 5.99% on the 36-month loan. Those rated G5 – the lowest rating – can expect rates of 35.89% on the 36-month loan. Generally, borrowers with good or excellent credit can expect rates below 15%, while borrowers with mediocre credit can expect rates between 15% and the upper rate limit. Grading and interest rates are similar for business borrowers. These rates are subject to change with prevailing market conditions.

Funding

If you qualify for a loan with Lending Club, you’ll receive multiple offers. Once you choose the best-looking offer, complete the online application, and verify your identity, Lending Club will start looking for investors to fund the loan. From start to finish, the entire process can take as little as a week if your financial profile is attractive to investors and the underwriting process produces no hiccups.

Lending Club works with a mix of individual and institutional investors, so it’s impossible to predict in advance exactly who will fund your loan. Once your loan is funded, the principal is deposited into your verified bank account within one to four business days, depending on your bank.

The personal loan origination fee ranges from 1% and 6%, depending on your loan grade and loan term. It’s automatically added to your principal and begins accruing interest immediately.

Origination fees on business loans range from 1% to 6%, depending on your grade (term doesn’t matter). These fees are deducted from the total amount of your loan, so the actual amount you receive may be up to 6% lower than your requested amount.

Repayment

Lending Club requires monthly repayments of a fixed amount. It automatically debits your bank account on the same day of the month, emailing a reminder a few days before to ensure sufficient funds in the account. If you’re more than 15 days late due to insufficient funds, you’ll be charged the greater of $15 or 5% of the total loan payment as a late payment fee, which doesn’t reduce your principal balance.

Loans more than 30 days past due may be reported to a collection agency. You can manually make additional payments or pay off your loan in full at any time with no prepayment penalties.

Eligibility

Personal Loans

Though Lending Club doesn’t release all the details of its proprietary application and screening process, borrowers with credit scores below 640 generally aren’t eligible. Additionally, borrowers must be at least 18 years old, have U.S. citizenship or long-term residency, reside in one of the states where Lending Club operates, and have a verified bank account. To verify your bank account, Lending Club makes two small trial deposits and asks you to confirm their amounts in your Lending Club account.

When evaluating an application, Lending Club looks at factors like credit score, credit history (length and activity), debt-to-income ratio, employment status, income, and homeownership status. Having a higher credit score, lower debt to income ratio, steady employment, and solid income increases your chances of approval and reduces your loan’s interest rate.

Business Loans

Business borrowers are subject to the same geographical, age, and citizenship requirements as individual borrowers. Additionally, business loan applicants must own at least 20% of a business with $50,000 or more in annual sales, have been a 20%-plus owner for at least two years, and be authorized to borrow on behalf of the business. These criteria are subject to change, so check with Lending Club before you apply.

When evaluating an application, Lending Club considers factors such as the business’s credit utilization, past payment history, credit history (length and activity), and cash flow. Businesses with longer credit histories, more robust cash flows, and timely past payment histories are more likely to be approved and enjoy a lower rate.

Application and Approval

To apply for a Lending Club loan, you need to provide basic contact information, bank account information, and your Social Security number. You also need to specify the desired amount, term (36 or 60 months), and purpose (such as debt consolidation, home improvement, and medical expenses) of your loan.

Lending Club verifies your bank account by making trial deposits, which can take one to three business days. It then conducts a thorough credit check, including a thorough evaluation of your personal or business credit history, using one or more credit scores and reports from the major credit reporting bureaus.

If you’re an individual borrower, Lending Club also verifies your employment status and income by requesting pay stubs or income tax statements and contacting your employer. This process can take up to 14 business days, though Lending Club says most applications are either approved or denied within seven business days (not including funding time). If you’re self-employed, Lending Club may request more documentation around your income and finances, lengthening the process.

Key Features

Lending Club’s additional features include:

Retirement Accounts

You can set up a Lending Club account as a traditional or Roth IRA. Having a retirement account with Lending Club doesn’t affect your ability to have a regular account, meaning you can set up multiple Lending Club accounts if desired.

Custodial Accounts

If you’re the parent or legal guardian of a minor child, you can also set up a custodial Lending Club account and control it until the child reaches age 21.

Note Trading

Lending Club has a partnership with Folio Investing that allows investors to buy and sell existing Notes on a secondary market. Depending on the borrower’s Lending Club rating, general credit history, and repayment history with Lending Club, Notes may trade at a premium or discount to regular face value ($25).

To execute Note trades, you need to be approved for a Folio Investing account. You can apply through Lending Club’s website. All transactions incur a 1% commission, payable to Folio. Note that Lending Club advises borrowers to “be prepared to hold any Note you purchase through to its maturity” – in other words, not to expect that you’ll be able to sell your Notes with Folio.

Multiple Outstanding Loans for Borrowers

Lending Club borrowers can have up to two outstanding loans at once. Cumulative balance restrictions apply – check with Lending Club for details. And note, before applying for a second loan, you must demonstrate consistent patterns of timely repayment and remain in good standing with Lending Club.

Patient Solutions Loans

Lending Club’s Patient Solutions vertical is a financing solution designed specifically for medical providers looking to offer a (relatively) low-cost financing option to their patients. It’s especially useful for providers that practice concierge medicine or eschew third-party payers (insurance and government-run reimbursement schemes such as Medicaid) altogether, since their patients typically face hefty out-of-pocket costs that require private financing.

Patient Solutions loans are underwritten on a borrower-specific basis, and approval is not guaranteed. As with other Lending Club loans, patients need to have solid credit to secure approval. Note that not all specialties are covered – Lending Club caters to dentists and certain medical specialists, such as bariatric surgeons and hair restoration specialists. This is subject to change, so check with Lending Club for up-to-date information.

Patient Solutions loans come in two flavors:

- Extended Plans: Rates range from 3.99% to 24.99% APR, depending on borrower credit and loan term. Terms range from 24 to 84 months. Principal ranges from $2,000 to $50,000. Specialties include dental, fertility, hair restoration, and weight loss.

- True No-Interest Loans: Rates stay at 0% APR for up to 24 months, then rise to 26.99% APR, depending on loan terms and borrower credit. Principal ranges from $499 to $32,000. Specialties include dental and hair restoration.

Credit-impaired borrowers may take advantage of promotional rate loans, which fix rates at 17.90% APR for up to 5 years, then rise to 26.99% APR for the remainder of the loan term.

Auto Refinancing Loans

If you’re looking for a loan product that provides breathing room on a vehicle purchase that stretches your ability to pay (such as an entry-level luxury car), you’ll want to look closer at Lending Club’s auto refinancing loans.

Lending Club brokers auto refinancing loans for car owners with rides in reasonably good shape: 10 years old or newer and fewer than 120,000 miles on the odometer. The loans themselves can come from one of several outside lenders, not Lending Club itself (or its individual investors).

Auto refinancing loan rates range from 3.99% APR to 24.99% APR, depending on the original rate and borrower credit. There are no origination, prepayment, or application fees, and the loans are generally originated much faster than traditional Lending Club loans. Loans need to be at least 1 month old and have at least 24 payments remaining. Principals range from $5,000 to $55,000.

Advantages

1. Lower Interest Rates for Borrowers

Though many factors influence Lending Club’s interest rates, its rates tend to be lower for borrowers with similar risk profiles. And Lending Club’s overall rate range is more favorable for borrowers than Prosper’s. Avant’s loans are much more expensive across the board, with effective annual rates ranging from about 30% to 90% (though shorter terms may reduce borrowers’ total interest payments on that platform). In fairness, Avant caters to borrowers with poorer credit.

2. Minimum Personal Loan Is $1,000

As an individual borrower, Lending Club lets you take out loans as small as $1,000. This can be useful if you need extra cash to pay down a credit card or medical bill, but don’t want to be saddled with the high monthly repayment that a larger loan would bring. With Prosper, you can’t get a loan smaller than $2,000.

3. Business Loans Available Up to $300,000

Lending Club offers loans of up to $300,000 to entrepreneurs and established business owners. This is higher than some smaller competitors, including some focused specifically on small businesses.

4. Lower Origination Fees Than Some Competitors

For some borrowers, Lending Club’s origination fees offer a better deal than other online lenders. For instance, Lending Club borrowers with an A rating pay origination fees between 1% and 3% on 36-month loans, depending on their sub-rating. At Prosper, A-rated borrowers pay origination fees of 4% for loans of the same term length. For 60-month loans, A-rated Lending Club borrowers pay a 3% origination fee, while similarly rated Prosper borrowers pay 5%.

5. Lower Default Rates

Among competing P2P platforms, Lending Club historically offers the lowest rates of borrower default. Since 2010, its default rate has been anywhere from 0.5% to 4% lower than Prosper’s. This means that you may see fewer losses as an investor. Just remember that past performance is not predictive of future results, and that default rates typically increase during economic downturns.

6. Niche Solutions for Patients and Car Owners

Lending Club’s Patient Solutions and auto refinancing loans are great for folks preoccupied with hefty medical bills or legacy car loans issued when rates were much higher (or their credit was much poorer). Since they’re more narrowly tailored to specific borrower sets, they tend to be faster to underwrite as well – great news for people who need relief yesterday.

Disadvantages

1. Minimum Investment of $1,000

Lending Club requires a $1,000 minimum investment for all investors. If you have a modest amount to invest or just want to try Lending Club without jumping headlong into the P2P lending world, this could be prohibitive.

2. Financial Restrictions for Investors

Lending Club’s financial restrictions for investors – limiting total investments to 10% or less of net worth and requiring minimum net worth or income thresholds – excludes some potential lenders from participating. While Prosper investors face similar restrictions if they live in states that impose them by law, it doesn’t impose them across the board like Lending Club. For investors with modest incomes or net worths, this means that Prosper may be the only option.

3. Not Suitable for Borrowers With Middling or Impaired Credit

Lending Club is designed for borrowers with decent to excellent credit. While your financial profile doesn’t need to be perfect to score a higher-interest loan here, you’re unlikely to be approved for a loan at any rate with a credit score south of 640. If your credit is impaired, look into a secured credit card instead (check out our roundup of the best secured credit cards on the market today for details). Avoid payday loans and other forms of predatory lending – they’re usually more trouble than they’re worth.

Final Word

Like other ambassadors for the sharing economy, peer-to-peer lending platforms such as Lending Club increase efficiency and transparency by cutting out the middle man – in this case, banks and other traditional lending institutions. Like the ridesharing companies forcing the taxi industry to rethink its business model, P2P lenders could force positive change in a financial industry that’s had trouble making new friends since the financial crisis.

And that’s not the only potential benefit. By directly connecting regular people willing to invest or borrow from their neighbors, P2P lending establishes personal connections that can’t exist between traditional financial institutions – even community banks and credit unions – and their borrowers. Stronger, more constructive communities could be the real legacy of Lending Club and its peers.

Have you ever used Lending Club to get or invest in a P2P loan?

The Verdict

Lending Club

Lending Club is a great alternative investment opportunity for qualified, risk-tolerant investors who care about giving their fellow consumers a leg up in the financial rat race. Likewise, it’s a more human way for everyday borrowers to get liquidity in (relatively) short order.

Lending Club does have some shortcomings. It’s most definitely not suitable for borrowers with impaired credit, nor for investors without ample (and demonstrable) assets and income. The platform itself is also a bit wonky. But, overall, there’s a lot to like here.

Key benefits include relatively low interest rates (compared with peers), low origination fees, high borrowing limits for businesses, low borrowing minimums for individuals, lower default rates than some competitors, and niche loans for certain borrowers.

Notable drawbacks include inflexible investment minimums, bias toward prime-credit borrowers, and asset and income restrictions for investors.

In sum, Lending Club is a solid choice for investors and borrowers alike. Just do your due diligence ahead of time and make sure you know what you’re getting into before you finalize your application.