Pros

Excellent cash-back program

Strong welcome offer

Attractive intro APR offer

Cons

Has an annual fee after the first year

Few redemption options for rewards

Has strict underwriting criteria

The Blue Cash Preferred® Card from American Express is a popular cash-back rewards credit card. It shares many of the same features and benefits as its stablemate, the Blue Cash Everyday Credit Card.

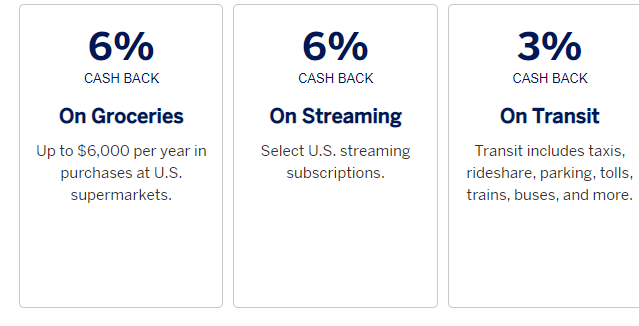

However, its cash-back rewards program is significantly more generous:

- 6% cash back on purchases made with select streaming and digital media services, such as Amazon Prime, Netflix, HBO, and Audible

- 6% cash back at U.S. supermarkets, up to $6,000 spent per year (then 1%)

- 3% cash back at U.S. gas stations and certain transit operators (including rideshare providers such as Lyft and Uber)

- 1% cash back everywhere else, including U.S. supermarket purchases above the annual spending cap

Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

Get up to $120 in statement credits annually when you pay for an Equinox+ membership at equinoxplus.com with your Blue Cash Preferred® Card. That’s $10 in statement credits each month. Enrollment required.

Thinking about getting The Disney Bundle which includes Disney+, Hulu, and ESPN+? Your decision made easy with $7/month back in the form of a statement credit after you spend $9.99 or more each month on an eligible subscription with your Blue Cash Preferred Card. Enrollment required.

Terms Apply.

Although its rewards are on the generous side, Blue Cash Preferred is comparable to many other mainstream cash-back rewards cards. Popular alternatives include the Chase Freedom Flex Credit Card and the Capital One Quicksilver Cash Rewards Credit Card.

Keep in mind that Blue Cash Preferred is one of the only cash-back cards that carry an annual fee. You’ll need to spend heavily enough on its favored categories to offset this recurring levy.

What Sets the Blue Cash Preferred Card Apart

The Blue Cash Preferred Card is a premium cash-back credit card from American Express. That alone sets it apart from the great mass of “ordinary” cash-back credit cards. But it has some other notable distinctions as well:

- Up to 6% Cash Back. That’s an attention-grabbing rate of return, 6%. And it applies not just to U.S. supermarket purchases up to $6,000 spent per year (then 1%), but all eligible streaming service purchases as well.

- 3% Back on Eligible Purchases. Blue Cash Preferred has broad 3% categories (that have expanded in recent years) covering gas at U.S. gas stations, taxis, rideshares, trains, buses, tolls, and other transit purchases.

- Nice Value-Added Perks. We’ll dwell on these more in the Key Features section below, but just know for now that they can be quite lucrative when you take full advantage.

As always, it needs to be said: Cash back accrues as Reward Dollars that can be redeemed for statement credits.

Key Features of the Blue Cash Preferred Card

These are the most important features of the Blue Cash Preferred Card from American Express. The main attraction here is the excellent rewards program and (to only a slightly lesser extent) the great welcome offer and intro APR promotion.

Welcome Offer

Earn $250 back after you spend at least $3,000 on purchases within the first 6 months. Cash back accrues as Reward Dollars that can be redeemed for statement credits.Cash Back Rewards & Redemption

Purchases made with digital media and streaming services, including (but not limited to) Amazon Prime, Netflix, HBO, Apple Music, and Audible, earn 6% cash back.

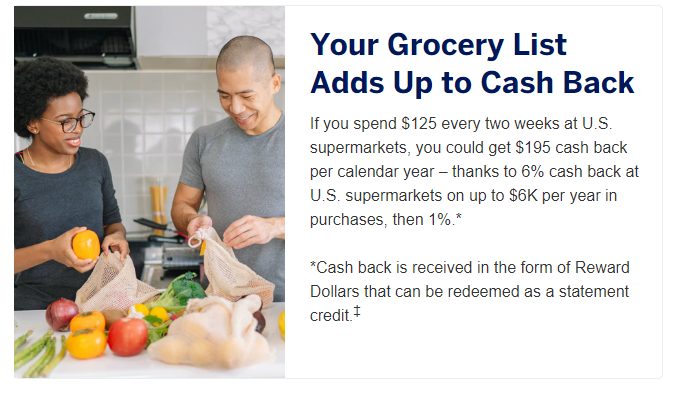

U.S. supermarket purchases earn 6% cash back, up to a $6,000 annual spending limit ($360 total cash back per year). After the $6,000 cap, supermarket purchases earn 1% cash back.

U.S. gas station and transit (including rideshare) purchases earn 3% cash back.

All other purchases earn 1% cash back.

Redeeming Cash Back

Cash back accrues as Reward Dollars that can be redeemed for statement credits or at Amazon.com checkout.

Note that American Express doesn’t include superstores such as Walmart and Target, nor warehouse club stores such as Costco and Sam’s Club, as “U.S. supermarkets” for the purposes of this card.

Introductory APR

Low Intro APR: 0% on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable APR of 19.24% to 29.99%. Variable APRs will not exceed 29.99%.

Disney Bundle Credit

Enroll your Blue Cash Preferred Card and use it to spend $9.99 or more each month on a Disney Bundle subscription. You’ll get a $7 monthly statement credit, or up to $84 back per year. This offer is valid only at Disneyplus.com, Hulu.com, or Plus.espn.com in the U.S. Enrollment is required and terms apply.

Equinox Credit

Use your Blue Cash Preferred Card to pay for your Equinox+ membership (available at equinoxplus.com) and you may be eligible to receive $10 in monthly statement credits — up to $120 back annually. Enrollment is required and terms apply.

Car Rental Loss and Damage Insurance

This is a standard credit card benefit that’s worth mentioning because Blue Cash Preferred is popular with drivers (including those driving rented vehicles).

To take advantage, simply use your eligible card to reserve and pay for your entire car rental, making sure to decline the collision damage waiver at the rental company counter. Do this and you may be covered for damage or theft of the vehicle in a covered territory, subject to policy limits and exclusions (and not including liability coverage).

Not all types of vehicles or rentals are covered and coverage is not available everywhere. Additional terms apply.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Important Fees

The annual fee is $95 each year. The foreign transaction fee is 2.7%.

Credit Required

This card recommends good to excellent credit. If you have any noteworthy credit blemishes, you’re unlikely to be approved.

For rates and fees of the Blue Cash Preferred® Card from American Express, please visit this rates and fees page.

Advantages of the Blue Cash Preferred Card

The Blue Cash Preferred Card’s top advantages include an excellent cash-back rewards program, a solid welcome offer, a nice 0% APR intro promotion, and easy-to-remember spending categories.

- Very Generous Cash-Back Rewards. Blue Cash Preferred has one of the most generous cash-back rewards programs around: 6% back at U.S. supermarkets (up to $6,000 spent per year), 3% back at U.S. gas stations, and 1% cash back everywhere else. Cash back accrues as Reward Dollars that can be redeemed for statement credits or at Amazon.com checkout. If you can tailor your spending accordingly, you’ll more than make up for the annual fee (after the first year) and leave other cards in the dust — see Amex’s graphic below for an illustration.

- Solid Welcome Offer. Blue Cash Preferred has an above-average welcome offer that’s not matched by most other cash-back credit cards. If you’re looking to juice your cash-back earnings right out of the gate, Blue Cash Preferred is a great choice.

- Nice Intro APR Promotion for Purchases and Balance Transfers. The 12-month 0% APR promotion for purchases and balance transfers matches offers from popular competitors, including Capital One.

- Spending Categories Don’t Change. Blue Cash Preferred’s spending categories never change – you can always expect the same cash-back earnings at U.S. supermarkets, gas stations, and everywhere else year-round. That’s a welcome change from cards with rotating categories, including Chase Freedom Flex. Freedom Flex changes its 5% cash-back categories each quarter, and you need to manually activate them to receive the benefit. However, keep in mind that neither carries annual fees.

- Additional Value-Added Benefits. Additional value-added benefits like the Disney Bundle and Equinox+ subscription credits further enhance this card’s value. Enrollment is required and terms apply, but if you can take advantage, I’d highly recommend doing so.

Disadvantages of the Blue Cash Preferred Card

The Blue Cash Preferred Card’s downsides include its annual fee and foreign transaction fee, its somewhat inflexible redemption options, and its strict underwriting requirements.

- Statement Credit and Amazon.com Is the Only Cash Back Redemption Options. You can only redeem your accumulated cash-back rewards for statement credits, not bank account deposits or paper checks. That’s much more restrictive than Chase Freedom Flex, which lets you redeem cash back for pretty much anything, and Citi Double Cash Card, which offers bank account deposits and paper checks in addition to statement credits.

- Has an Annual Fee and Foreign Transaction Fee. Blue Cash Preferred’s annual fee is somewhat unusual in the cash-back card world. It’s a significant drawback for cardholders who don’t spend enough to justify the outlay. Meanwhile, the foreign transaction fee is a bummer for frequent international travelers. The Bank of America Cash Rewards Credit Card, Capital One Quicksilver Cash Rewards Credit Card, and Citi Double Cash all lack annual fees.

- Charges Penalty Interest. Blue Cash Preferred’s high penalty APR stands in unfavorable contrast to the nonexistent penalty APR of Chase Freedom.

How the Blue Cash Preferred Card Stacks Up

Before you move forward with the Blue Cash Preferred Card, take a moment to see how it stacks up against another popular Amex cash-back credit card: the Blue Cash Everyday Card.

| Blue Cash Preferred | Blue Cash Everyday | |

| 6% Rewards | U.S. supermarkets up to $6,000 spend annually (then 1%); eligible streaming purchases | None |

| 3% Rewards | Eligible transit purchases; gas purchases at U.S. gas stations | U.S. supermarkets, U.S. online retail purchases, and gas at U.S. gas stations (up to $6,000 spend annually per category, then 1%) |

| 1% Rewards | All other eligible purchases | All other eligible purchases |

| Welcome Offer | Yes | Yes |

| Annual Fee | $0 in the first year, then $95 (see rates & fees) | $0 |

For rates and fees of the Blue Cash Preferred® Card from American Express, please visit this rates and fees page.

Final Word

The Blue Cash Preferred® Card from American Express has one of the most generous rewards programs of any cash-back credit card, but there’s a catch: the $95 annual fee.

If you don’t spend enough at the supermarket to approach or exceed the $6,000 annual spending limit, or don’t shop frequently at U.S. gas stations, consider a no-annual-fee cash-back credit card with similar, less generous benefits, such as Blue Cash Everyday.

Alternatively, opt for a category-based rewards card, such as Chase Freedom, which makes up for less generous overall cash-back benefits with rotating 5% cash-back categories and less exacting credit score requirements.

For rates and fees of the Blue Cash Preferred® Card from American Express, please visit this rates and fees page.

Pros

Excellent cash-back program

Strong welcome offer

Attractive intro APR offer

Cons

Has an annual fee after the first year

Few redemption options for rewards

Has strict underwriting criteria