Pros

No annual fee

Earn up to 5% cash back that fits your spending

Strong sign-up bonus

Cons

Low baseline cash-back rate (1%)

5% bonus cash capped at $500 monthly spend

Not for new-to-credit applicants

The new Citi Custom Cash Card is a cash-back credit card with no annual fee and a generous rewards program that favors everyday spending. With no quarterly rotating categories or cash back activation required, it’s a notable improvement on traditional category-based cash back credit cards like Chase Freedom Flex.

The Citi Custom Cash Card shines on two other fronts as well. It has one of the best sign-up bonuses of any no-annual-fee credit card on the market, and it boasts a very long 0% APR introductory promotion that applies to both purchases and balance transfers. Although its foreign transaction fee is a downer for jet-setting cardholders, there’s not much to complain about here otherwise.

Thinking about upgrading your current cash-back card to a new model? Intrigued by what you’ve learned so far about the Citi Custom Cash Card, a Mastercard from one of the most popular credit card issuers around? Keep reading for more about this card’s features, benefits, and overall suitability for consumers like you.

What Sets the Citi Custom Cash Card Apart

The Citi Custom Cash Card has three features that deserve special mention:

- Earn 5% Back With Little Effort. Unlike some 5% cash-back cards that require manual activation, have rotating categories, or limit bonus earnings to specific permanent categories, Citi Custom Cash is hands-off. You’ll automatically earn 5% cash back on up to $500 in purchases in your top spending category each month — no activation required.

- Long 0% APR Introductory Period. This isn’t unique among cash-back cards, but it’s welcome nonetheless. It applies to purchases and balance transfers for 15 months from account opening, though balance transfers must be made within 4 months of account opening to qualify for the interest-free period.

- Lots of Redemption Options. Though potentially overwhelming for credit card novices, the Citi Thank You rewards portal has a ton of redemption options, so it’s great for folks who tire of redeeming for statement credits month after month after month.

Key Features of the Citi Custom Cash Card

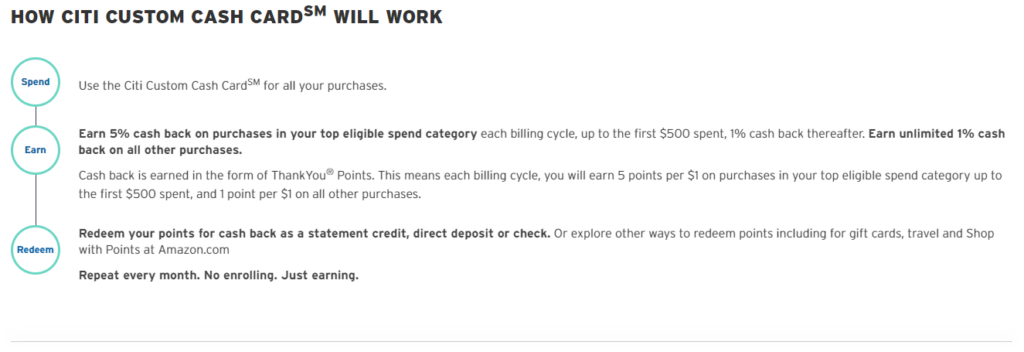

The Citi Custom Cash Card has a generous sign-up bonus, a solid ongoing cash back rewards program, and an impressive 0% APR introductory promotion. Cash back arrives as ThankYou points, Citi’s loyalty currency — worth $0.01 per point when redeemed for cash equivalents like statement credits and bank account deposits.

Sign-Up Bonus

Earn $200 bonus cash, fulfilled as 20,000 ThankYou points, after spending $1,500 in eligible purchases during the first 6 months your account is open.Earning Cash-Back Rewards

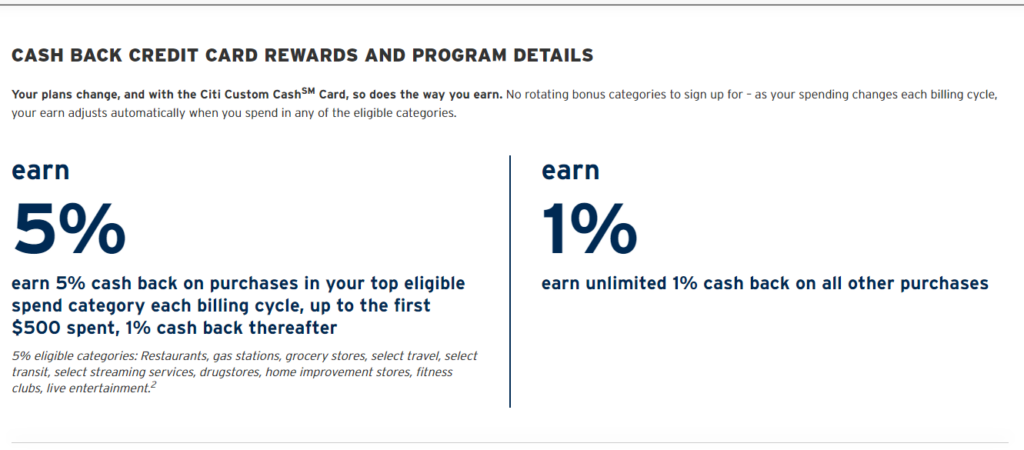

Citi Custom Cash has a two-tiered rewards program.

First, all eligible purchases in the cardholder’s top monthly spending category (of the eight permanently eligible categories) earn 5% cash back (5 Citi ThankYou points per $1 spent), up to $500 in monthly spending in that category. The spending categories eligible for bonus cash back are:

- Restaurants

- Gas stations

- Select transit

- Select travel

- Select streaming services

- Drugstores

- Home improvement stores

- Live entertainment

There’s no limit to how frequently the cardholder’s top monthly spending category can change. But bear in mind that the $500 monthly spending cap effectively limits bonus cash-back earnings to $25 per month or $300 per year.

Second, all other eligible purchases earn 1% cash back (1 ThankYou point per $1 spent), with no caps or restrictions on earning potential. This category includes purchases in the top monthly spending category above the $500 monthly spending cap.

Redeeming Cash-Back Rewards

ThankYou points can be redeemed for virtually anything in the Citi ThankYou Rewards portal. Optimal redemptions include statement credits or bank account deposits, both of which value points at $0.01 apiece.

Cardholders may also redeem for Amazon purchases, gift cards, merchandise, and other items, but those may value points lower than $0.01 apiece. Here’s more from Citi:

Introductory APR

Enjoy 0% APR for 15 months after account opening on purchases and for 15 months from the date of transfer for balance transfers. Thereafter, regular variable APR applies — currently 18.99% to 28.99%, depending on your creditworthiness and prevailing rates.

Qualifying balance transfers must be completed within 4 months of account opening. A balance transfer fee applies.

Important Fees

The Citi Custom Cash Card has no annual fee. Foreign transactions cost 3% of the total transaction amount. Other fees may apply.

Credit Required

Citi Custom Cash requires a good to excellent credit score. That’s roughly 700 or better on the FICO scale, though don’t take it to the bank as every application is different.

In any case, applicants with limited, poor, or fair credit are unlikely to qualify for this rewards credit card.

Advantages of the Citi Custom Cash Card

The Citi Custom Cash Card has a lot of advantages over flat-rate cash-back credit cards and traditional quarterly rotating category cards as well. Plus, with a generous sign-up bonus and intro APR promotion, it offers a lot for new account holders to like.

- No Annual Fee. The Citi Custom Cash Card has no annual fee. Cardholders who don’t plan to use it as their primary credit card can rest assured that it won’t burn a hole in their pockets between uses.

- Strong Sign-up Bonus. Citi Custom Cash has a strong sign-up bonus with a relatively low spending requirement and no spend categories to worry about. And it allows 6 months to reach the minimum spend threshold, double the usual 3 months.

- Lots of Opportunities to Earn 5% Cash Back. Unlike the original crop of cash-back credit cards with 5% bonus cash back categories, Citi Custom Cash offers a permanent array of bonus categories and automatically rewards cardholders for using their favorite. To be specific, Custom Cash has eight fairly broad spending categories eligible for bonus earnings: restaurants, gas stations, select travel, select streaming services, select transit, drugstores, home improvement stores, and live entertainment. You’ll automatically receive 5% cash back in whichever of these categories you spend the most in each month (up to $500 in monthly spending).

- Very Long 0% APR Introductory Promotion on Purchases and Balance Transfers. Citi Custom Cash has one of the longest 0% APR introductory promotions of any cash-back card on the market, exceeded only by a handful of cards at any given time — including by its stablemate, the Citi Double Cash Card, which has an even longer balance transfer promotion. Citi Custom Cash’s 0% APR promotion is notable for covering both purchases and balance transfers, rather than only one or the other as is often the case. All in all, this is one of the best credit cards around for applicants looking to avoid interest charges early on.

- Lots of Cash-Back Redemption Options. Citi Custom Cash cardholders earn ThankYou points redeemable for cash equivalents (statement credits, bank account deposits) and for gift cards, general merchandise, and more. Needless to say, it’s a nice loyalty currency for cardholders who like keeping their options open, and an advantage over straight cash-back cards like Citi Double Cash.

- No Quarterly Rotating Cash-Back Categories to Worry About. Unlike Chase Freedom Flex and other credit cards with rotating categories, Citi Custom Cash doesn’t ask cardholders to keep track of categories that change by the month or quarter. Neither does it require cardholders to manually activate bonus cash back in those categories, a perennial drawback of Flex and its ilk. Here, bonus earnings are all automatic, all the time.

Disadvantages of the Citi Custom Cash Card

The Citi Custom Cash Card isn’t perfect. Its drawbacks include a relatively low baseline cash-back rate and a foreign transaction fee that’s less than ideal for cardholders who regularly venture outside the U.S. or purchase goods from international vendors.

- Low Baseline Cash-Back Rate. Citi Custom Cash has a low baseline cash-back rate of just 1%, or 1 ThankYou point per $1 spent. This rate applies to all purchases except the first $500 in eligible purchases in the cardholder’s top spending category for the month. For higher-spending cardholders, that’s apt to mean the bulk of all card spending. By contrast, 2% flat-rate cards like Citi Double Cash earn unlimited 2% cash back on all eligible purchases, all the time, as long as you pay your statement in full each month.

- Has a Foreign Transaction Fee. Citi Custom Cash has a 3% foreign transaction fee. That’s a drawback relative to competing cards that don’t have foreign transaction fees and of particular concern to cardholders who frequently travel abroad or patronize international vendors.

- Not Appropriate for First-Time Credit Card Users and Those With Impaired Credit. Citi Custom Cash requires good to excellent credit. It’s not accessible to first-time credit card users with limited credit history, nor to applicants with impaired credit (low FICO credit scores).

- Bonus Cash-Back Earnings Capped at $500 in Monthly Spending. Citi Custom Cash caps bonus cash-back earnings at $25 per month, equating to no more than $500 in monthly bonus category spending. That’s a disadvantage for heavy spenders who consistently hit the spending cap.

How the Citi Custom Cash Card Stacks Up

If you’re not 100% sold on the Citi Custom Cash Card, you have options. One of this card’s closest competitors is the Bank of America Customized Cash Rewards Credit Card, which also has a flexible cash-back program that’s easy to fit to your needs.

Here’s our side-by-side comparison. Check out our full Bank of America Customized Cash Rewards Credit Card review for more details.

| Custom Cash Card | Customized Cash Rewards | |

| 5% Cash Back | Yes, on up to $500 spent in the top eligible monthly spending | None |

| 3% Cash Back | None | Yes, choose one of six categories each month or default to gas |

| 2% Cash Back | None | Yes, always at grocery store and wholesale clubs |

| Bonus Tier Cap | $500 spent each month in your top eligible spend category | $2,500 in combined quarterly spending between the 2% and 3% tiers |

| 1% Cash Back | Unlimited on all other eligible purchases | Unlimited on all other eligible purchases |

| Welcome Offer Value | $200 with qualifying spend | $200 with qualifying spend |

| Annual Fee | $0 | $0 |

Final Word

The Citi Custom Cash Card improves upon the category-based cash-back card with one sensible tweak to the model: automatically rewarding spending in the cardholder’s top spending category for the month, rather than in an arbitrary category or two that rotates every quarter.

Nothing against old-school category cards like Chase Freedom Flex. With advance purchase planning, maximizing Chase Freedom Flex’s 5% bonus categories is absolutely doable. Diligent Freedom Flex cardholders with ample budgets can easily extract the maximum $300 annual bonus cash from their cards.

Then again, Citi Custom Cash also holds the promise of up to $300 in bonus cash each year, housed in a much simpler rewards scheme. No manual activation, no checking the cash-back calendar every quarter — just everyday spending that automatically earns five times the baseline cash-back rate. What could be simpler?

Pros

No annual fee

Earn up to 5% cash back that fits your spending

Strong sign-up bonus

Cons

Low baseline cash-back rate (1%)

5% bonus cash capped at $500 monthly spend

Not for new-to-credit applicants