Pros

No annual fee

Solid early spend bonus

Nice lineup of travel transfer partners

Cons

Mile values capped at $0.01 apiece when redeemed with Capital One

Rewards rate capped at 1.5x

No travel loyalty program benefits

Capital One Spark 1.5X Miles Select (also known as Capital One Spark Miles Select for Business, or simply Spark Miles Select) is a business credit card with no annual fee and a straightforward travel rewards program that accrues miles on every purchase. Miles can then be redeemed for virtually any type of travel purchase, including airfare, hotel stays, and car rentals. Unlike many brand-specific business travel cards, such as Gold Delta SkyMiles Business, Spark Miles Select assigns a fixed value to miles redeemed for travel expenses: $0.01 per mile.

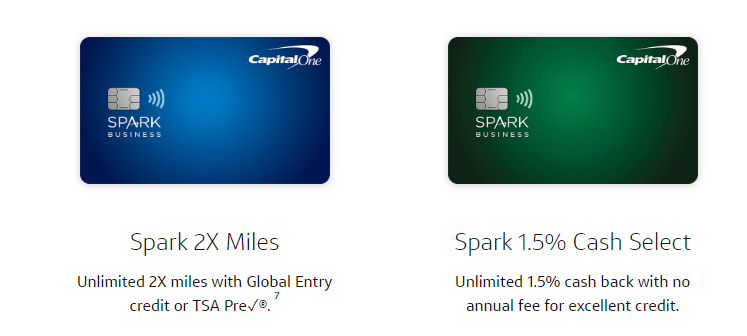

Spark Miles Select is comparable to numerous other business travel cards, including stablemate Capital One Spark Miles for Business, CitiBusiness / AAdvantage Platinum Select, and American Express Business Platinum. It’s worth noting that many competing cards carry annual fees ranging from less than $100 to more than $500.

Capital One Spark Miles Select is also very similar to Capital One Spark Cash Select. Since miles always have a fixed value of $0.01 apiece on travel expenses, this card effectively earns a 1.5% cash back rate when you redeem for travel. The principal difference is that miles are typically redeemed for travel, whereas the Spark Cash Select’s cash back earnings are redeemed for cash.

What Sets Capital One Spark 1.5X Miles Select Apart

I’ll be honest: Capital One Spark Miles Select is not a groundbreaking credit card by any stretch. It’s not on my list of the best business travel cards, that’s for sure. So it stands out for good and not-so-good reasons.

- No Annual Fee. This is pretty unusual for a business travel credit card and worth noting as a result. On the other hand, you get what you pay for, and Spark Miles Select isn’t particularly generous elsewhere.

- Good Early Spend Bonus for a No-Annual-Fee Card. One bright spot is the early spend bonus, which is worth up to $200 when redeemed for travel. It doesn’t require a hefty early spend, either, so most applicants can probably clear it with little trouble.

- Nice Travel Transfer Partner Lineup. Another bright spot, and an unusual one for a no-annual-fee card, is Spark Miles Select’s lineup of more than a dozen travel transfer partners. It has few standouts (no American Airlines, Delta, or United, for example) but offers good value overall, particularly for international travelers.

- Hard Cap on Mile Values When Redeemed With Capital One. Your miles are worth $0.01 or less when redeemed with Capital One, period. You have to transfer them out to capture higher values, which is at minimum inconvenient and could be unrealistic if you don’t have the opportunity to book regularly with any of Capital One’s travel partners.

Key Features of Capital One Spark 1.5X Miles Select

These are the key features of the Spark Miles Select card.

Early Spend Bonus

When you spend at least $3,000 within 3 months of opening your account, you get 20,000 bonus miles. That’s worth $200 at redemption.

Earning Travel Rewards

With one notable exception, all eligible purchases earn an unlimited 1.5 miles per $1 spent with no caps or restrictions. Since miles are worth $0.01 apiece at redemption, this equates to a 1.5% cash back rate on all purchases.

The exception: Hotel and rental car purchases made through Capital One Travel using your Spark Miles Select card earn 5 miles per $1 spent.

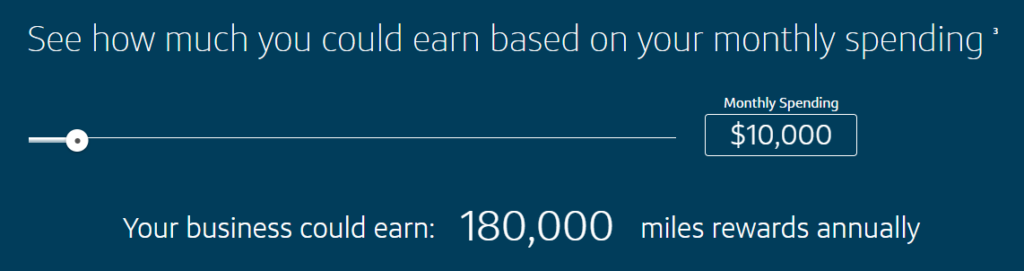

Though the base rate isn’t anything to write home about, earnings can still add up for heavy spenders. Here’s an example from Capital One showing how much you could earn if you spend $10,000 per month on average with your Spark Miles Select card.

Redeeming Travel Rewards

You can redeem accumulated miles directly for travel in one of two ways.

First, you can use statement credits to offset travel purchases you’ve already made for up to 90 days from the purchase date. If you don’t have enough miles to offset an entire purchase, you can use whatever miles you do have, subject to a 2,500-mile minimum.

Second, you can use your miles to book airfare, hotels, car rentals, and other travel purchases directly through Capital One’s travel portal. If you redeem in this manner, there’s no set redemption minimum to worry about. Neither redemption method comes with blackout dates or seat restrictions.

Finally, you can redeem miles for non-travel items, including cash, gift cards, merchandise, and general statement credits. Redemption values for non-travel redemptions vary widely and are subject to change, and they’re generally not as good a deal as travel redemptions.

Transfer to Capital One’s Travel Partners

You can also transfer miles (subject to conversion ratios and transfer minimums) to any of Capital One’s 10+ leading travel partners. The lineup is subject to change, but notable partners include:

- Choice Hotels

- Air Canada

- Aeromexico

- Air France KLM

- British Airways

Introductory APR

This card has a 0% APR on purchases for 9 months, then variable regular APR applies.

Important Fees

There is no annual fee, foreign transaction fee, balance transfer fee, or fee for additional employee cards. The late payment fee is $39, and the cash advance fee is the greater of $10 or 3%.

Quarterly and Year-End Account Summary

At the end of every quarter, and again at the end of the year, you receive a categorized, itemized summary of your spending during the period. This includes detailed reports on employee card spending, if applicable.

Downloadable Purchase Records

You can easily download purchase records in formats compatible with Quicken, Excel, and QuickBooks, simplifying business accounting and tax preparation.

Additional Benefits

Capital One Spark Miles Select for Business comes with some other noteworthy benefits, including 24/7 emergency travel assistance (with lost card replacement), complimentary collision and theft protection on car rentals paid for in full with the card, and fraud detection.

Credit Required

This card requires good to excellent credit. A minor ding or two probably won’t disqualify your application, but more serious credit issues certainly will.

Advantages of Capital One Spark 1.5X Miles Select

Here’s what Spark Miles Select has going for it. Take a look and decide whether these advantages are enough to outweigh the downsizes described below.

- No Annual Fee. Capital One Spark Miles Select doesn’t have an annual fee, which is great for budget-conscious business owners who don’t intend to use the card enough to offset an annual levy. Many competing cards, including CitiBusiness / AAdvantage Platinum Select Card ($95), do come with annual fees.

- No Foreign Transaction Fees. This card doesn’t charge foreign transaction fees. That’s great news for cardholders who do business overseas, and a nice advantage over competing cards that charge foreign transaction fees of 2% to 3%.

- Flexible Travel Rewards Redemption. You can redeem Capital One miles for basically any travel purchase, either at the moment of purchase or retroactively via statement credits. Depending on how you redeem, there’s also no minimum redemption threshold. This is a disadvantage relative to brand-specific business travel cards, such as the Delta SkyMIles Gold Business American Express Card and the CitiBusiness / AAdvantage Platinum Select Card, which restrict redemption to specific travel types and brands (airfare and airlines).

- 10+ Travel Transfer Partners. Though major domestic airlines and most major U.S. hotel chains are absent, Capital One’s travel transfer partner lineup still has some great companies, including Choice Hotels and Air Canada. They offer the best redemption values in many cases as well, sometimes boosting mile values by 200% or 300% (or more).

- Solid Early Spend Bonus. This card comes with a solid early spend bonus: 20,000 miles ($200 value) when you spend $3,000 or more within 3 months of account opening. Some competitor cards, notably Capital One’s own Spark Classic, don’t offer early spend bonuses at all (though those cards may be better fits for business owners with less-than-perfect credit.

- No Blackout Dates or Seat Restrictions. Spark Miles Select never imposes blackout dates or seat restrictions on award travel. This dramatically simplifies the redemption process and eliminates the frustration of being unable to redeem miles on a particular date or in a particular class. Many branded business travel rewards cards do have blackout dates and seat restrictions, especially during busy travel times.

- No Rotating or Tiered Spending Categories. This card’s travel rewards scheme is super-straightforward: Every $1 spent earns 1.5 miles, with no exceptions: a flat 1.5% rate of return on your credit card spending. That’s a welcome change from business travel rewards cards with more complicated mileage schemes, such as the CitiBusiness / AAdvantage Platinum Select Credit Card and American Express Business Gold Card ($295 annual fee; $375 if application is received on or after 2/1/24).

Disadvantages of Capital One Spark 1.5X Miles Select

Consider these drawbacks before applying. Only you can decide whether they’re enough to wave you off this card and drive you to another business travel rewards product.

- Earning Rate Is Capped at 1.5% on Most Purchases. With the exception of hotel and rental car purchases made through Capital One Travel, the Capital One Spark Miles Select card always earns 1.5 miles per $1 spent. Since miles are always worth $0.01 apiece, this translates to a 1.5% cash back rate. Though this is a nice baseline earning rate, it’s a far cry from some competing cards’ high-end rates: the American Express Business Gold Card earns 4 points for every $1 spent in your 2 top-spending categories each year (up to the first $150,000 in annual spending), while Marriott Bonvoy Business® American Express® Card earns 6 points for every $1 spent on hotel stays.

- Mile Values Generally Capped at $0.01 Apiece. In the case of Marriott Bonvoy Business and many other brand-specific business cards, miles and points are often worth well over $0.01 apiece (higher than $0.02 apiece, at times) depending on the specific routes or hotel properties for which they’re redeemed. This is a further disadvantage for Spark Miles Select, which due to Capital One miles’ fixed value prevents cardholders from getting more value out of already-accumulated miles or points. The only way to get around this constraint is to transfer your miles to Capital One’s travel partners and redeem at (potentially) higher values within their loyalty programs.

- No Travel Loyalty Program Benefits or Membership Status Tiers. Spark Miles Select doesn’t confer membership in frequent flyer or travel loyalty programs, which, along with other benefits, typically come with such cards. Many other premium travel credit cards do, though often at the cost of a recurring annual fee.

- Limited Travel Benefits. This card has few fringe benefits or creature comforts that regular travelers long for, such as priority boarding or airport lounge access. If you’re looking for a card that helps you travel in style, rather than just travel for less, look to a higher-end card such as the American Express Business Platinum Card or the more reasonably priced Amex Business Gold Card.

How Spark Miles Select Stacks Up

Not sure whether a business travel rewards card is right for you? If you’re a Capital One fan, you have a very similar alternative: the Capital One Spark Cash Select Card. See how the two compare.

| Spark Miles Select | Spark Cash Select | |

| Regular Rewards Rate | 1.5% cash back on most eligible purchases | 1.5x miles on most eligible purchases |

| Capital One Travel Rate | 5% cash back | 5x miles |

| Redemption Value | $0.01 per point or less | $0.01 per mile or less when redeemed with Capital One |

| Transfer Partners? | No | Yes, 10+ travel partners |

| 0% APR Offer | None | 9 months on purchases, then variable regular APR applies |

| Annual Fee | $0 | $0 |

Final Word

Capital One Spark Miles Select for Business doesn’t have the highest mile-earning rate or juiciest fringe benefit package. Beyond the rewards program, it’s actually a pretty bare-bones card.

However, if you’re not overly loyal to a particular hotel or airline brand, it’s hard to go wrong here. Even if you also have a branded rewards card in your wallet, you’re likely to be grateful for your Spark Miles Select card when it comes time to book your next holiday or peak-season flight.

Pros

No annual fee

Solid early spend bonus

Nice lineup of travel transfer partners

Cons

Mile values capped at $0.01 apiece when redeemed with Capital One

Rewards rate capped at 1.5x

No travel loyalty program benefits