Pros

Flexible redemption options for rewards

Generous lineup of value-added perks

Solid welcome offer

Cons

High annual fee

Requires excellent credit

Mediocre value for statement credit redemptions

The American Express® Gold Card is an exclusive card with a $250 annual fee and no preset spending limit. It features a generous rewards program built around travel and everyday expenses.

The catch, of course, is that this card is reserved for people with truly excellent credit, and thus isn’t appropriate for first-timers or those with any serious fiscal blemishes. It’s comparable to other American Express rewards cards, including The Platinum Card from American Express and the Blue Cash Preferred Card. It’s also comparable to cards issued by other companies, including the Marriott Bonvoy Boundless™ Credit Card from Chase.

Intrigued by the American Express Gold Card? Here’s what you need to know about it — which I’ll refer to as, simply, “the Gold Card” from here on out — before making a decision to apply (or not).

What Sets the American Express Gold Card Apart

The Gold Card has several notable features. Some are unique to the card itself, while others are products of the broader Amex ecosystem.

- Up to $120 in Dining Credits Each Year. You can get up to $10 in dining credits per month, or $120 per year when fully utilized, on eligible spending on your Gold Card. Eligible purchases include takeout and delivery. Terms apply and enrollment is required, but do check out this potentially valuable perk.

- Up to $120 in Uber Credits Each Year (Uber Cash). The Gold Card has a similar benefit for Uber fans: up to $10 per month in credits or $120 per year when fully utilized. Uber Eats purchases count as well.

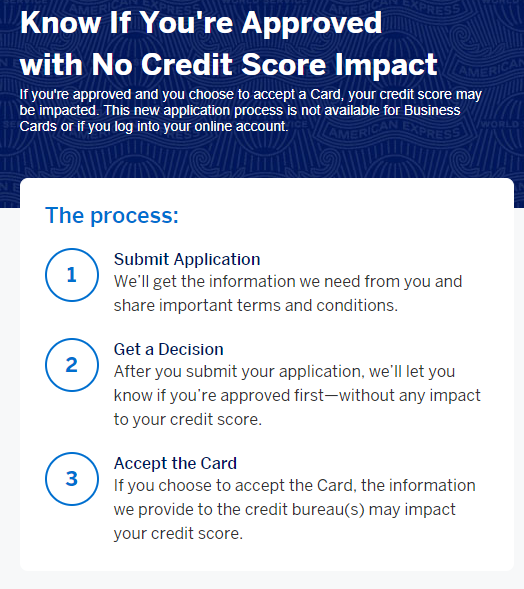

- Find Out If You’re Approved Without Impacting Your Credit Score. Amex lets you find out if you’re approved for a particular card (including the Gold Card) before doing a hard pull on your credit report (which can temporarily lower your score). This isn’t a scammy pre-approval offer; you’re actually applying for the card. Amex just holds off on the credit pull unless you’re approved and accept the offer.

- 4x Return on Restaurant Purchases. The Gold Card earns 4x points on eligible restaurant purchases, including takeout and delivery. This is just about the best you can do on restaurant purchases in the credit card world, and it’s a powerful pairing with the generous dining credit.

Key Features of the American Express Gold Card

These are the key features of the Gold Card. Review them carefully to decide whether this card is right for you or whether you’re better suited to a different product.

Welcome Offer

After you spend at least $6,000 within 6 months of opening your account, you get 60,000 bonus Membership Rewards points. That’s worth $600 or more, depending on how you redeem.

Earning Rewards

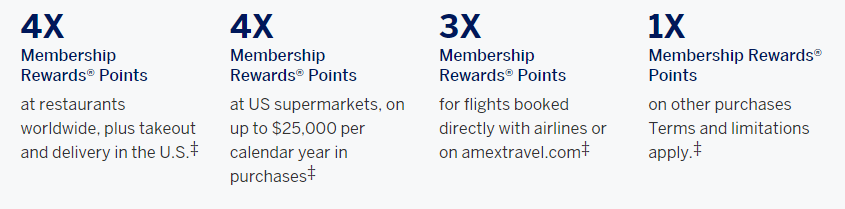

This card earns rewards at the following rates:

- 4 points per $1 spent at restaurants, including takeout and delivery

- 4 points per $1 spent on the first $25,000 in annual purchases at U.S. supermarkets

- 3 points per $1 spent on purchases of airfare purchased directly through airlines or amextravel.com (but not third-party booking websites such as Kayak and Expedia)

- 1 point per $1 spent on all other purchases

Keep in mind that American Express doesn’t consider warehouse clubs such as Costco or big-box discounters such as Walmart to be supermarkets, and restaurants contained within hotels may not be considered restaurants for categorization purposes.

Redeeming Rewards

You can redeem your accumulated rewards, starting at a minimum of 1,000 points, for a variety of purchases and cash equivalents available at American Express’s Membership Rewards portal: travel, general merchandise, Uber and taxi rides, gift cards, restaurant meals, statement credits, and more.

Points are worth $0.005 to $0.01 apiece, depending on how they’re redeemed. Gift cards and travel (both $0.01 per point) tend to offer the best value, particularly compared with statement credits ($0.006 per point) and general merchandise (as low as ($0.005 per point).

Uber Credit (Uber Cash)

You’re entitled to up to $120 per year ($10 per month) in statement credits to offset purchases made in the Uber app, including Uber Eats and Uber rides. To qualify, you must add your Gold card as a payment method in the app. Enrollment is required.

Restaurant Spending Credit

Earn up to $10 in statement credits each month on spending with Amex dining partners, up to a total potential savings of $120 per calendar year. Partners include Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations. Terms apply and enrollment is required.

Complimentary Hotel Room Upgrades and Credits

When you book a hotel stay of at least 2 nights with your Gold Card, you get a complimentary room upgrade (subject to availability) and $75 hotel credit. You can use the hotel credit at any time during your stay for dining and incidentals, such as spa treatments and resort services.

Entertainment Benefits

The Gold Card offers a slew of entertainment benefits, including pre-sale ticketing, exclusive (cardholder-only) events such as Broadway shows and concerts, and complimentary preferred seating (front row, orchestra level, lounge section, and so on) for select sporting events and musical performances. Enrollment is required.

Important Fees

The annual fee is $250, and there is no foreign transaction fee. Returned payments cost up to $39 each, and late payments, defined as any unpaid balance older than 2 months, cost the greater of $39 or 2.99% of the late amount. Balance transfers and cash advances aren’t allowed.

Know If You’re Approved With No Credit Score Impact

You can find out if you’re approved for the Gold Card with no initial impact to your credit score. This isn’t a preapproval — it’s a proper application and approval that you can accept if you wish. But if you don’t, or you’re not approved in the first place, your credit score won’t suffer just because you applied.

The screenshot below (courtesy of Amex) has more details.

Credit Required

This card requires excellent credit. Any significant credit blemishes are likely to disqualify your application.

Advantages of the American Express Gold Card

These are the most important advantages of the American Express Gold Card. Evaluate them carefully to determine whether it makes sense for you.

- Flexible Redemption Options. The Gold Card accrues Membership Rewards points that can be redeemed for virtually anything: travel, general merchandise, local transportation, gift cards, statement credits, and more. Plus, redemptions start at just 1,000 points, a $5 to $10 value. These are big selling points relative to many hotel and airline rewards cards, which generally require at least 5,000 (and sometimes 10,000 or more) points for redemption, and typically permit redemptions only with specific hotel or airline brands.

- Solid Welcome Offer. The Gold Card has a great welcome offer that requires a moderate amount of spending over the first 6 months of cardmembership.

- Up to $120 Annual Credit for Frequent Diners and Up to $120 Annual Credit for Uber App users. This card’s $10-per-month dining credit is worth up to $120 per year when fully utilized. That’s great news for cardholders who don’t always feel like cooking. And the $10-per-month Uber Cash deal is great for cardholders who regularly use Uber’s rideshare or food delivery services. Enrollment is required to enjoy these benefits.

- No Foreign Transaction Fees. This card has no foreign transaction fees, which is a nice perk for frequent overseas travelers. By comparison, Citi ThankYou Preferred has a 3% foreign transaction fee. U.S. Bank FlexPerks Visa Signature has a 2% to 3% foreign transaction fee, depending on denomination, while AmEx EveryDay Preferred‘s foreign transaction fee is always 2.7%.

- No Preset Spending Limits. The Gold Card never comes with preset spending limits, although American Express reserves the right to limit future spending based on purchasing and payment patterns. Many competing rewards cards, including otherwise generous options like Citi ThankYou Premier, do impose spending limits (generally $5,000 and up). No Preset Spending Limit means your spending limit is flexible. Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

Disadvantages of the American Express Gold Card

These are the biggest disadvantages of the American Express Gold Card. Only you can decide whether they’re out-and-out dealbreakers.

- High Annual Fee. The Gold Card comes with a $250 annual fee. That’s significantly higher than many other rewards cards, including Citi ThankYou Preferred ($0) and Citi ThankYou Premier ($95). If you don’t take full advantage of the Gold Card’s value-added benefits, such as hotel room upgrades and airline credits, you’re better off with a less expensive card.

- Requires Near-Flawless Credit. Although American Express doesn’t divulge the precise credit score minimum needed for approval, nor does it discuss other screening criteria in detail, it makes no secret of the fact that the Gold Card is for people with excellent credit. If you have any noteworthy blemishes on your credit report, you should not expect to be approved for this card. Rewards cards geared toward less-experienced card users, such as Capital One VentureOne, are better fits for applicants with average to good credit, while mid-tier rewards cards such as Citi ThankYou Preferred are better for applicants with very good credit.

- Low Redemption Value for Statement Credits. The Gold Card’s statement credit redemption option values earned points at $0.006 apiece. If you redeem 10,000 points for a statement credit, you get $60. That’s a low redemption rate for this category. By comparison, Capital One Venture, a general-purpose travel rewards card with a $59 annual fee, values points at $0.01 apiece.

How the American Express Gold Card Stacks Up

The Gold Card is a generous but not extravagant American Express product without any competitors I would call “direct.”

But it’s clearly geared towards foodies. That makes it a reasonable alternative to Savor Rewards From Capital One, another card with very generous benefits for people who buy groceries and dine at restaurants regularly.

Here’s how the two cards compare.

| Amex Gold Card | Savor Rewards Card | |

| Dining Rewards | 4x points | 4% cash back |

| Supermarket Rewards | 4x points on the first $25,000 spent per year at U.S. supermarkets | 3% cash back on all eligible supermarket purchases |

| Travel Rewards | 3x points on purchases of airfare purchased directly from airlines or amextravel.com | 5% cash back on eligible Capital One Travel purchases |

| Uber Credit | $10 per month / up to $120 per year | Eligible Uber Eats purchases earn 10% cash back and qualify for a 10% discount Eligible Uber rides earn 10% cash back and qualify for a 5% discount |

| Dining Credit | $10 per month / up to $120 per year | None |

| Annual Fee | $250 (see rates and fees) | $95 |

Final Word

The American Express® Gold Card isn’t totally free of drawbacks. But with an excellent rewards program and no preset spending limit, it could earn you quite a few Membership Rewards points with regular use. Perhaps it’s time to start imagining what you’ll do with the Gold Card’s impressive spending power.

For rates and fees of the American Express® Gold Card, please visit this rates and fees page.

Pros

Flexible redemption options for rewards

Generous lineup of value-added perks

Solid welcome offer

Cons

High annual fee

Requires excellent credit

Mediocre value for statement credit redemptions